The Government of India has recently introduced a significant update regarding the time limits for reporting e-Invoices on the Invoice Registration Portal (IRP). Starting from April 1, 2025, taxpayers with an Annual Aggregate Turnover (AATO) of ₹10 crores and above must comply with a strict 30-day reporting limit for e-Invoices. This advisory marks a major shift from the earlier threshold of ₹100 crores, now extending compliance requirements to a larger number of businesses.

New Reporting Requirement for e-Invoices

The update regarding the e-Invoice compliance rule stems from an earlier advisory dated September 13, 2023. It aims to ensure that e-Invoices are reported in a timely manner to bring uniformity and transparency to tax reporting. This advisory establishes that businesses with an AATO of ₹10 crores and above must report e-Invoices on the IRP portal within 30 days of issuance. Failing to comply with this requirement could lead to non-acceptance of invoices beyond the given timeline, causing disruptions in business operations and GST compliance.

Key Details of the Advisory

- Applicability: Effective from April 1, 2025, all taxpayers with an AATO of ₹10 crores or more must report invoices within a 30-day window from the date of issuance.

- Document Coverage: This restriction applies to all document types for which an Invoice Reference Number (IRN) is required. This includes invoices, credit notes, and debit notes.

- No Reporting for Older Invoices: Any e-Invoice dated beyond 30 days from the date of its issuance cannot be uploaded or registered on the IRP portal. The in-built validation in the IRP will prevent reporting of outdated invoices.

- For instance, an invoice dated April 1, 2025, cannot be reported after April 30, 2025. Businesses must ensure timely compliance within this window.

- Exemptions for Smaller Businesses: The time limit is currently applicable only to taxpayers whose AATO exceeds ₹10 crores. Businesses below this threshold do not have to comply with this restriction for the time being.

Why Timely Reporting Matters

The new compliance requirement emphasizes the need for businesses to have efficient invoicing systems in place. Timely reporting is crucial as it directly impacts the availability of Input Tax Credit (ITC) for the recipient. Non-compliance could also lead to unnecessary disputes, operational disruptions, and penalties. Therefore, taxpayers are advised to implement robust invoicing systems that can seamlessly handle real-time reporting.

Key Case Laws on e-Invoicing Compliance

- XYZ Traders vs. GST Authorities: In this case, XYZ Traders was penalized for delayed submission of invoices, leading to denial of ITC for its customers. This case highlights the importance of adhering to e-Invoicing timelines to avoid penalties and ensure seamless ITC claims.

- ABC Manufacturing Ltd. vs. Commissioner of GST: The case involved a dispute regarding delayed reporting of credit notes. The court ruled that timely reporting is essential for maintaining transparency and ensuring the proper flow of ITC benefits, underscoring the necessity of compliance with reporting requirements.

Steps to Ensure Compliance

- Upgrade Your Accounting Systems: Ensure that your ERP/accounting software is integrated with the e-Invoicing system for automatic reporting.

- Staff Training: Conduct workshops or training sessions to familiarize accounting and finance teams with the new compliance timelines.

- Use Automation Tools: Leverage tools that automate invoice generation and reporting to minimize manual errors and delays.

Conclusion

The Government’s decision to impose a stricter time limit for e-Invoice reporting aims to enhance transparency, reduce errors, and facilitate better control over tax compliance. With the lowered threshold to ₹10 crores, a broader range of businesses must now prepare to meet these requirements. By adopting automated invoicing solutions and ensuring proactive compliance, businesses can avoid disruptions and take advantage of the seamless flow of ITC.

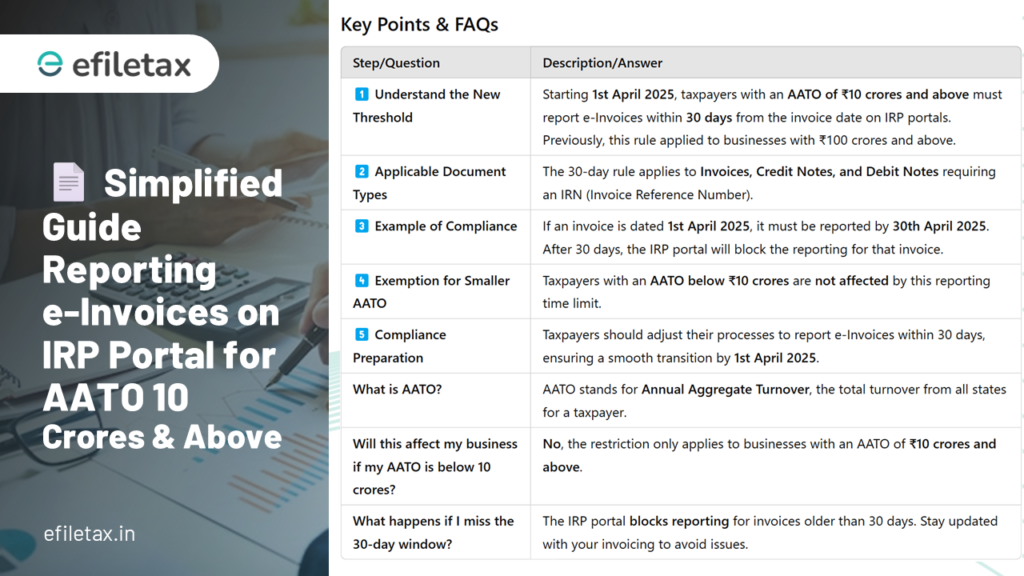

Key Points & FAQs

| Step/Question | Description/Answer |

|---|---|

| 1️⃣ Understand the New Threshold | Starting 1st April 2025, taxpayers with an AATO of ₹10 crores and above must report e-Invoices within 30 days from the invoice date on IRP portals. Previously, this rule applied to businesses with ₹100 crores and above. |

| 2️⃣ Applicable Document Types | The 30-day rule applies to Invoices, Credit Notes, and Debit Notes requiring an IRN (Invoice Reference Number). |

| 3️⃣ Example of Compliance | If an invoice is dated 1st April 2025, it must be reported by 30th April 2025. After 30 days, the IRP portal will block the reporting for that invoice. |

| 4️⃣ Exemption for Smaller AATO | Taxpayers with an AATO below ₹10 crores are not affected by this reporting time limit. |

| 5️⃣ Compliance Preparation | Taxpayers should adjust their processes to report e-Invoices within 30 days, ensuring a smooth transition by 1st April 2025. |

| What is AATO? | AATO stands for Annual Aggregate Turnover, the total turnover from all states for a taxpayer. |

| Will this affect my business if my AATO is below 10 crores? | No, the restriction only applies to businesses with an AATO of ₹10 crores and above. |

| What happens if I miss the 30-day window? | The IRP portal blocks reporting for invoices older than 30 days. Stay updated with your invoicing to avoid issues. |