If you’re buying luxury items like designer watches or home theatres worth over ₹10 lakh, you’re now liable to pay 1% Tax Collected at Source (TCS) under Section 206C(1F).

This move, introduced via Budget 2024, aims to track high-value spending and expand the tax net.

Let’s decode what this means for taxpayers and sellers alike.

📌 What is TCS under Section 206C(1F)?

Section 206C(1F) mandates that a seller must collect 1% tax on sale of specified luxury goods exceeding ₹10 lakh in value.

Applicability:

- Only if the sale value exceeds ₹10 lakh

- Buyer must provide PAN

- Collected by seller and deposited with the IT Department

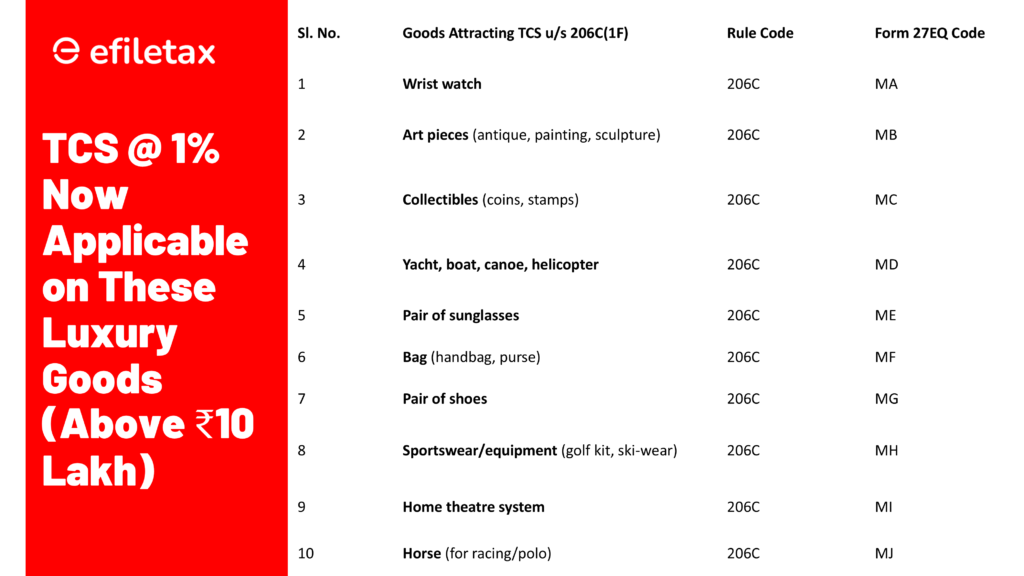

🎯 Luxury Goods Covered

As per CBDT notifications, the following goods are covered:

- Wrist watches

- Antiques and artwork

- Collectibles (stamps, coins)

- Yachts, boats, helicopters

- Sunglasses, handbags

- High-end shoes and sportswear

- Golf kits, ski-wear

- Home theatre systems

- Horses for racing or polo

Example:

Buying a home theatre for ₹30 lakh? You’ll pay ₹30,000 (1%) as TCS at purchase.

💡 How TCS Affects Buyers

- Not an Extra Tax: TCS is not an additional burden—it’s an advance tax.

- ITR Claimable: You can claim TCS as tax credit while filing your return.

- Refundable: If your tax liability is lower, the excess TCS is refunded.

- TCS Certificate: Seller must provide Form 27D once TCS is deposited.

🔍 Legal Backing and Budget Intent

As per Budget 2024, this expansion of Section 206C(1F) is meant to:

“Track expenditure on luxury goods by high net worth individuals and deepen the tax base.”

This aligns with the government’s efforts to tighten compliance and reduce tax evasion by tracing lifestyle spends.

Source: Budget 2024 Memorandum

✅ Compliance Tips for Sellers

- Collect PAN of buyer

- File TCS return using Form 27EQ

- Issue Form 27D to buyer

- Deposit TCS before the 7th of next month

📌 Expert Tip

“Always reconcile TCS data with AIS before filing ITR. Mismatches can delay refunds.”

📲 Want Help Filing TCS or ITR?

Our experts at Efiletax can help you with:

- TCS return filing

- ITR claiming of TCS

- Business tax compliance

FAQs

Q1. Is TCS also applicable to used luxury goods?

Only if value exceeds ₹10 lakh and the seller falls under TCS provisions.

Q2. Can I claim TCS even if I have no tax liability?

Yes. You can claim a refund via ITR.

Q3. What happens if seller doesn’t deposit TCS?

Penalty and interest may apply; buyer may face mismatch issues in AIS.

Section 206C(1F) mandates 1% TCS on luxury goods over ₹10 lakh—like watches, yachts, and collectibles. Buyers can claim this as tax credit in ITR. The rule helps trace high-value spending, with compliance required from both buyers and sellers