Foreign Income Reporting: CBDT’s Compliance-Cum-Awareness Campaign for AY 2024-25

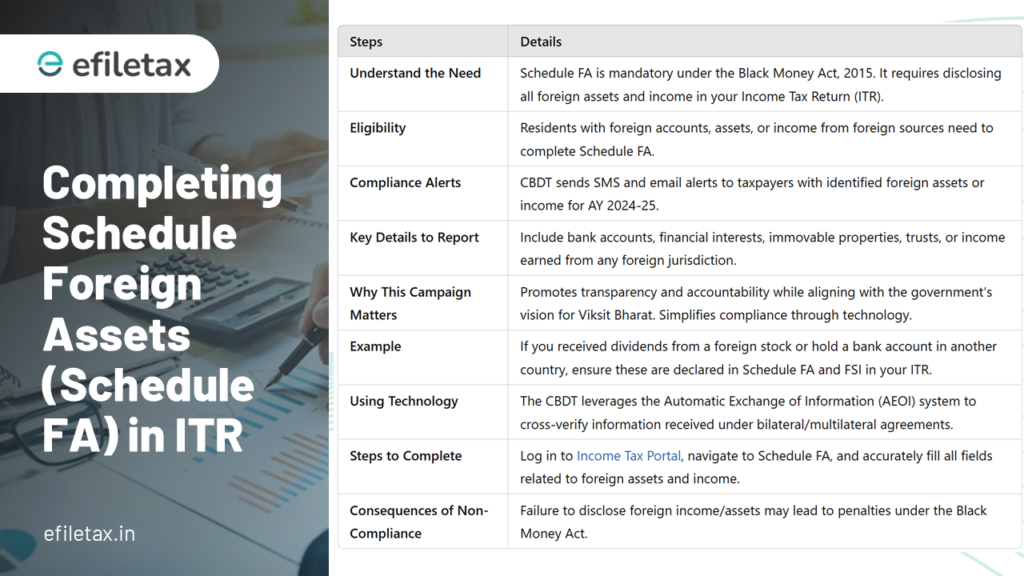

The Central Board of Direct Taxes (CBDT) has initiated a Compliance-Cum-Awareness Campaign for Assessment Year (AY) 2024-25 to simplify the process of accurately completing Schedule Foreign Assets (Schedule FA) and Foreign Income Reporting in ITR from foreign sources in Income Tax Returns (ITRs). This effort is aligned with the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, which mandates transparent disclosure of foreign assets and income.

This initiative not only ensures compliance but also supports the government’s vision for a transparent and developed India. Taxpayers who accurately report their foreign income contribute to a culture of voluntary compliance and accountability.

Key Highlights of the Campaign

- Informational Messages via SMS/Email

Taxpayers who have already filed their ITRs for AY 2024-25 will receive SMS and email reminders to verify and complete Schedule FA. These messages are tailored for individuals flagged under bilateral and multilateral agreements, indicating they may hold foreign assets or have foreign income. - Focus on High-Value Foreign Assets

Particular emphasis is placed on taxpayers with substantial foreign holdings. The campaign aims to guide them in fulfilling their legal obligations under the Black Money Act. - Technology-Driven Approach

The Income Tax Department leverages data from the Automatic Exchange of Information (AEOI) to identify non-disclosure cases. This use of technology reduces manual intervention and fosters a taxpayer-friendly system. - Encouraging Voluntary Compliance

The campaign underscores the importance of accurately reporting foreign income, reinforcing the government’s commitment to transparency and economic growth.

Why Accurate Reporting is Crucial

Non-compliance with Schedule FA and FSI can result in heavy penalties under the Black Money Act. The penalties are designed to deter taxpayers from hiding undisclosed income or assets abroad. Here’s why you should act promptly:

- Avoid Legal Consequences: Failure to disclose foreign assets could lead to penalties of up to 120% of the tax due, and even prosecution in extreme cases.

- Foster Transparency: Compliance builds trust with the government and enhances your financial credibility.

How to Complete Schedule FA

Follow these simple steps to ensure accurate reporting:

- Log into the Income Tax e-Filing Portal: Visit www.incometax.gov.in and log into your account.

- Navigate to Schedule FA: Open your ITR form and locate the Schedule Foreign Assets section.

- Provide Detailed Information: Include all foreign bank accounts, financial interests, immovable property, and foreign trusts.

- Cross-Check Your Entries: Verify details using the AEOI-provided data or consult your financial advisor.

- Submit and Review: Once completed, submit your ITR and check for confirmation.

Practical Example Foreign Income Reporting in ITR

Scenario: Ravi, an Indian resident, owns a foreign bank account in Singapore and earns dividends from shares held there. Under the campaign, Ravi receives an email prompting him to verify his disclosures in Schedule FA. Upon review, he realises he missed reporting the account details. Following the guide, Ravi updates his ITR, avoiding penalties and ensuring compliance.

FAQs Foreign Income Reporting in ITR

| Question | Answer |

|---|---|

| What is Schedule Foreign Assets (FA)? | It is a section in ITR for disclosing foreign-held assets and financial interests. |

| Who should fill Schedule FA? | Indian residents holding foreign assets or income must complete this schedule. |

| What happens if I fail to comply? | Non-disclosure can lead to penalties and prosecution under the Black Money Act. |

| Can I revise my ITR after filing? | Yes, you can file a revised return to correct errors in Schedule FA. |

| Where can I find help? | Visit www.incometax.gov.in for resources. |

Final Thoughts

CBDT’s campaign simplifies the process of reporting foreign income while promoting a culture of compliance. Ensure your ITR is accurate and up-to-date to avoid penalties and contribute to India’s economic growth.

“Compliance is not just about following laws—it’s about building trust.”

🔗 Visit the official Income Tax Department website for more details.