Capital Gains Tax Exemption: Sections 54 & 54F Simplified

The Income Tax Act provides significant relief to taxpayers with long-term capital gains through Sections 54 and 54F, encouraging reinvestment in residential properties. Here’s a comprehensive guide to help you understand the eligibility, conditions, and recent updates for both sections.

Section 54 vs. Section 54F: Key Highlights

| Feature | Section 54 | Section 54F |

|---|---|---|

| Applicable to | Sale of residential property | Sale of assets other than residential property |

| Eligibility | Individuals and HUFs | Individuals and HUFs |

| Reinvestment Asset | New residential property | New residential property |

| Maximum Exemption | Lower of capital gains or reinvestment in new property | Proportional to reinvestment in new property |

| New Property Location | Must be in India | Must be in India |

| Exemption Cap | ₹10 crore (as per Finance Act 2023) | ₹10 crore (as per Finance Act 2023) |

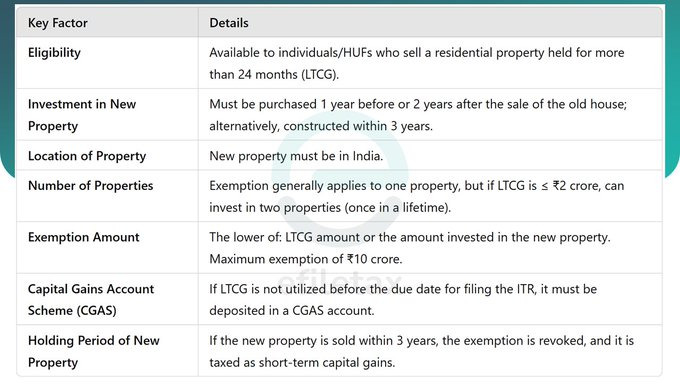

1. Eligibility for Exemptions

Section 54:

- Taxpayers selling residential property held for more than 24 months (long-term asset).

Section 54F:

- Taxpayers selling any other capital asset, except residential property.

2. Reinvestment Timeline

- Purchase:

- Buy a new property within 1 year before or 2 years after the sale of the original asset.

- Construction:

- Complete construction within 3 years from the date of sale.

3. Maximum Exemption Calculation

Section 54:

The exemption is the lower of:

- The capital gains amount, or

- The investment made in the new residential property.

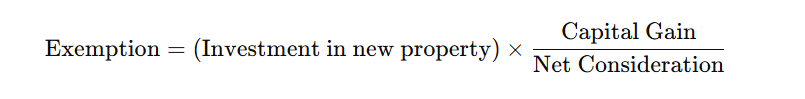

Section 54F:

4. Capital Gain Account Scheme (CGAS)

If the capital gains are not utilized before the ITR filing deadline, deposit the unutilized amount in a Capital Gain Account Scheme (CGAS). Ensure the funds are reinvested within the stipulated timeline to retain the exemption.

5. Recent Amendments (Finance Act 2023)

- A ₹10 crore cap applies to exemptions under both sections.

- Taxpayers can exercise a one-time option to invest in two properties if the gains do not exceed ₹2 crore (available under Section 54).

6. Withdrawal of Exemption

The exemption will be revoked if:

- The new house is not purchased or constructed within the specified timeframe.

- The new house is sold within 3 years, and the capital gains become short-term gains, attracting a higher tax rate.

7. Key Example

Suppose Mr. A sells his residential property for a capital gain of ₹1 crore and reinvests ₹80 lakh in a new residential property. Here’s the breakdown:

- Under Section 54:

- ₹80 lakh is exempted, and ₹20 lakh is taxable.

- Under Section 54F (for a non-residential asset):

FAQs

Q1: Can I claim both Section 54 and Section 54F exemptions simultaneously?

No, you can only claim one exemption based on the type of asset sold.

Q2: Can I claim an exemption for property purchased abroad?

No, the new property must be located in India to qualify for the exemption.

Q3: What happens if I fail to utilize the amount deposited in CGAS?

Unused funds in CGAS will be treated as capital gains and taxed accordingly.

Conclusion

Both Section 54 and Section 54F offer valuable opportunities to save taxes on long-term capital gains. By understanding their provisions and planning your reinvestments strategically, you can make the most of these exemptions.

Call to Action:

Looking for expert guidance to optimize your tax savings? Contact Efiletax for professional advice and hassle-free compliance services.