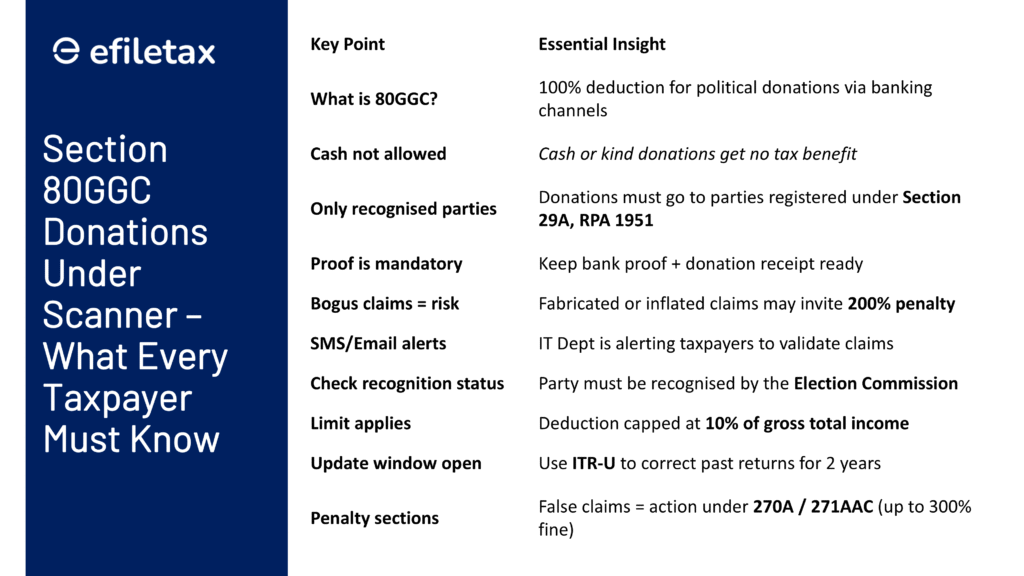

Section 80GGC Scrutiny: Political Donation Claims Under Tax Scanner

The Income Tax Department has ramped up its scrutiny of Section 80GGC political donation claims, sending SMS and email alerts to taxpayers across India. This comes after detecting a surge in bogus or inflated deduction claims over the last few assessment years.

🔍 What Is Section 80GGC?

- Allows 100% deduction for contributions to:

- Registered political parties (under Section 29A of RPA, 1951)

- Electoral trusts notified by the Central Government

- Deduction available only to individuals (non-companies)

- Payment must be made digitally – cash/kind not allowed

- Donation must not exceed 10% of gross total income

📲 Why Are Taxpayers Getting SMS Alerts?

The department suspects:

- Fake or inflated donations were claimed

- Payments made in cash or to unregistered parties

- No documentary proof available to support claims

This scrutiny is part of a larger crackdown on data-driven tax evasion.

⚠️ Key Compliance Rules for Section 80GGC

| Requirement | Must Follow? | Notes |

|---|---|---|

| Payment via cheque/DD/net banking/card | ✅ Yes | Cash not allowed |

| Donate only to registered political parties | ✅ Yes | Must be registered under RPA, 1951 |

| Proof of donation | ✅ Mandatory | Keep receipt + bank statement |

| Claim exceeds 10% of gross income | ❌ Not allowed | Will be disallowed |

| Donations to unrecognised entities | ❌ Ineligible | Verify party’s status |

🧾 What Should Taxpayers Do Now?

If you received a notice or alert:

- Check party registration status (Election Commission website)

- Cross-verify payment method (bank mode mandatory)

- Gather documents: receipt + bank transaction proof

- If claim is incorrect, file an Updated ITR under Section 139(8A)

⚖️ Legal Risk: False Claims = 200%+ Penalty

| Provision | Consequence |

|---|---|

| Section 270A | Penalty of 200% for under-reporting |

| Section 271AAC | Additional penalty up to 300% for misreporting |

| Section 80GGC breach | Full disallowance of the deduction |

| ITR mismatch | Case flagged for assessment or audit |

🛡️ Expert Legal View: It’s About More Than Tax

“Misuse of Section 80GGC threatens democratic transparency. There must be a digital verification system and better audit mechanisms for political entities.”

— Abhishek A Rastogi, Supreme Court Advocate

✅ Practical Tips to Stay Compliant

- Don’t donate in cash

- Use only recognised political parties

- Keep receipts and payment proofs safe

- Recheck your ITR before filing

- When in doubt, consult a tax advisor

📅 Updated Return Filing: A Second Chance

Under Section 139(8A), you can file an updated ITR within 24 months of the original deadline—perfect for those who need to reverse false or exaggerated claims without heavy penalties.

Section 80GGC donations are under tax radar. Ensure your political contributions are digital, verified, and to recognised parties. False claims invite 200%+ penalties. File updated ITRs to avoid scrutiny.

❓FAQ Section

Q1: Can I claim a deduction for cash donations to political parties?

No. Only digital payments are eligible under Section 80GGC.

Q2: What if I donated to a party later found to be unregistered?

Such deductions will be disallowed. Always verify registration with the Election Commission.

Q3: What’s the penalty for false claims?

Penalties under Sections 270A and 271AAC can go up to 300% of tax evaded, plus disallowance of deduction.

Q4: Can I file a revised return now?

You can file an Updated ITR under Section 139(8A) within 2 years of the original deadline.

🔗 Need Help?

If you’ve received a Section 80GGC notice or need help with Updated ITR filing, our team at Efiletax is here to assist.