Many Indian taxpayers confuse Section 44AD vs 44ADA while filing returns. A simple error — like declaring professional income under Section 44AD instead of 44ADA — can trigger AI-based scrutiny, notices under Section 142(1), and penalties. This blog explains the difference, real-life consequences, and how to avoid such costly mistakes.

Difference Between Section 44AD and Section 44ADA

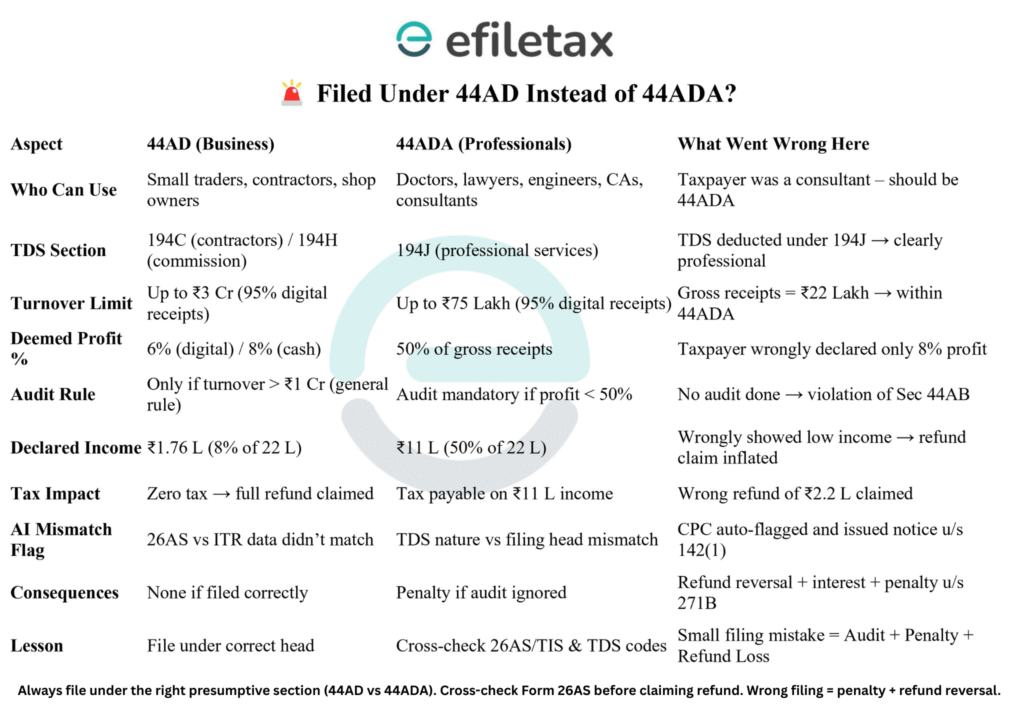

| Aspect | Section 44AD (Business) | Section 44ADA (Profession) |

|---|---|---|

| Who Can Use | Small businesses (traders, contractors, manufacturers, shopkeepers). Not for specified professions. | Professionals (doctors, lawyers, architects, accountants, consultants, etc.) covered under Section 44AA. |

| Turnover / Gross Receipt Limit | Up to ₹3 crore (if 95% digital receipts). | Up to ₹75 lakh (if 95% digital receipts). |

| Deemed Profit | 6% (digital) or 8% (cash) of turnover. | 50% of gross receipts. |

| Audit Requirement | If turnover > ₹1 crore or profit declared < 6%/8%. | If receipts > ₹50 lakh or profit declared < 50%. |

| ITR Form | ITR-4 (Presumptive Income – Business). | ITR-4 or ITR-3 (Presumptive Income – Profession). |

Legal Reference: Income Tax Act, 1961 – Sections 44AD and 44ADA.

Case Study: Mistake of Filing Under 44AD Instead of 44ADA

- A professional earned ₹22,00,000 in FY 2024–25.

- TDS of ₹2,20,000 was deducted under Section 194J (professional services).

- Instead of 44ADA, they wrongly filed under 44AD, showing 8% profit (₹1,76,000).

- Claimed a full refund of ₹2,20,000, assuming no tax liability.

Why the Tax Department Sent Notice

- Mismatch in Nature of Income: 194J TDS = professional fees, but ITR filed under business income.

- Wrong Profit Ratio: Under 44ADA, deemed profit = ₹11,00,000 (50%), not ₹1,76,000.

- No Audit Done: Declaring below 50% profit without books & audit = violation of Section 44AB.

Consequences of Wrong Filing

- Notice u/s 142(1) for mismatches.

- Refund reversal + interest (u/s 234A/B/C, 220).

- Audit penalty u/s 271B: 0.5% of gross receipts (max ₹1,50,000).

- Risk of demand & recovery including bank account attachment.

- Possible penalty for under-reporting u/s 270A.

How to Avoid This Mistake

✅ Always check Form 26AS/TIS/AIS before filing.

✅ Use the correct presumptive scheme – 44AD for business, 44ADA for professionals.

✅ If declaring lower profits, maintain books and get an audit done.

✅ Respond promptly to any notice u/s 142(1) with clarification.

✅ Seek expert guidance for income > ₹50 lakh or mixed business + professional income.

Expert View

Many professionals mistakenly assume 44AD gives “lower taxable income.” But AI systems today match TDS sections, ITR heads, and refund ratios in real time. Filing under the wrong scheme not only delays refunds but can also create penalties higher than the tax saved.

FAQs

Q1. Can a professional opt for Section 44AD?

No. Professionals notified under Section 44AA (lawyers, doctors, engineers, etc.) can only use Section 44ADA.

Q2. What if I declared income under the wrong section?

You can file a revised return before the deadline (generally December 31 of the assessment year). If missed, respond to notices with corrected computation.

Q3. Is audit always mandatory under 44ADA?

No. Audit is only required if:

- Gross receipts > ₹50 lakh, or

- Declared profit < 50% of gross receipts.

Key Takeaway

A filing mistake between Section 44AD vs 44ADA can snowball into notices, refund reversal, and penalties. Always cross-check your ITR with Form 26AS and seek professional help before submitting.

👉 Need help with presumptive taxation, audit compliance, or responding to IT notices? Contact efiletax today for expert assistance.

Filing under the wrong scheme (Section 44AD vs 44ADA) can trigger notices, refund reversals, and audit penalties. Learn the key differences, real case consequences, and how to avoid compliance pitfalls. Always cross-check Form 26AS and file under the correct head to stay safe.