Safeguard duty on steel flat products has been provisionally imposed by the Indian government at 12% ad valorem, applicable for 200 days. This move targets a sudden surge in steel imports that threatens the local industry. Here’s a simplified breakdown to help Indian importers, consultants, and businesses navigate this update.

What Triggered This Duty?

As per DGTR Notification No. 22/01/2024-DGTR:

- There was a sharp and sudden surge in imports of steel flat products.

- This surge is causing or threatening serious injury to Indian producers.

- Delay in action could cause irreparable damage, prompting immediate provisional measures.

Key Duty Highlights

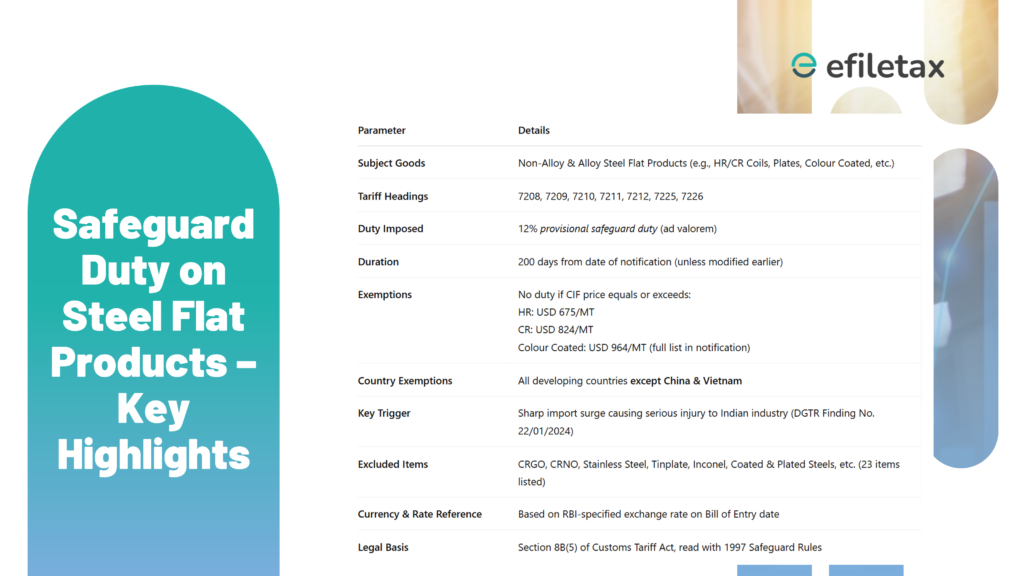

| Parameter | Details |

|---|---|

| Goods Covered | Non-Alloy & Alloy Steel Flat Products (e.g. HR/CR Coils, Plates, Coated) |

| Tariff Headings | 7208, 7209, 7210, 7211, 7212, 7225, 7226 |

| Rate | 12% provisional safeguard duty (ad valorem) |

| Duration | 200 days from 21st April 2025 |

| Legal Basis | Section 8B(5), Customs Tariff Act, 1975 + Safeguard Rules, 1997 |

| Currency Reference | RBI-specified exchange rate on Bill of Entry date |

Price-Based Exemptions

No duty if CIF price (Cost, Insurance, Freight) equals or exceeds:

- Hot Rolled (HR): USD 675/MT

- Cold Rolled (CR): USD 824/MT

- Colour Coated: USD 964/MT

- Full list as per Notification No. 01/2025-Customs (SG) dated 21st April 2025

Country-Based Exemptions

- Applies to all developing countries

- Except China & Vietnam (explicitly excluded from exemption)

Excluded Items (Partial List)

- Stainless Steel

- Tinplate

- CRGO / CRNO

- Inconel

- Electro Galvanised, Coated, Plated Steels (23 items in total)

Full exclusion list in Official Notification PDF (external link)

Expert Insight

“This safeguard measure is more than a tariff—it’s a signal. Importers must re-evaluate supply chains and pricing strategies fast.”

— Steel trade consultant, Mumbai

Why This Matters for Businesses

- Immediate cost increase of 12% on key steel imports

- Potential supply chain delays if compliance isn’t aligned

- Crucial for manufacturing, construction, and infrastructure sectors relying on imports

FAQs

Q1. Is this safeguard duty permanent?

No. It’s a provisional duty for 200 days unless extended, revoked, or replaced by final measures.

Q2. Can we challenge this duty legally?

Challenges can be made if procedural lapses or injury claims are unsupported, often requiring legal and trade remedy consultation.

Q3. What is CIF value in this context?

It’s the import value including Cost, Insurance, and Freight, as assessed under Section 14 of the Customs Act.

India has imposed a 12% safeguard duty on steel flat products for 200 days. Exemptions apply based on price and country of origin. This move aims to protect local industry from import surges.