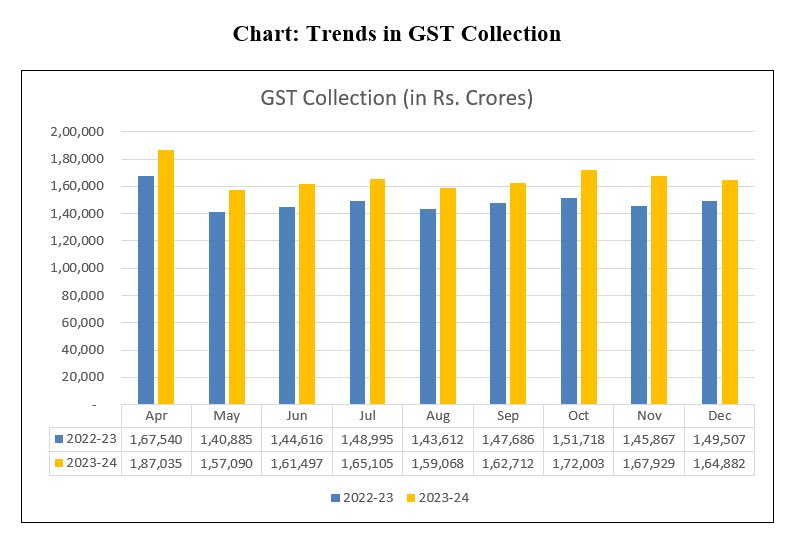

Strong and Steady: The Goods and Services Tax (GST) regime continues to demonstrate impressive growth, with a 12% YoY increase in gross collection to ₹14.97 lakh crore for the April-December 2023 period. This marks a significant rise compared to the ₹13.40 lakh crore collected in the same period of the previous year.

Momentum Maintained: The positive trend extends to the monthly average as well. The first nine months of FY24 witnessed an average gross GST collection of ₹1.66 lakh crore, representing a 12% increase compared to the corresponding period in FY23 (₹1.49 lakh crore).

December Delivers: December 2023 continued the upward trajectory, with gross GST revenue reaching ₹1,64,882 crore. This noteworthy figure underscores the resilience of the economy and indicates robust business activity.

Breaking Down the Numbers:

- CGST: ₹30,443 crore

- SGST: ₹37,935 crore

- IGST: ₹84,255 crore (including ₹41,534 crore from import of goods)

- Cess: ₹12,249 crore (including ₹1,079 crore from import of goods)

Key Highlights:

- December marks the seventh consecutive month with GST collections exceeding ₹1.60 lakh crore.

- Both Centre and States received healthy revenue shares, with ₹70,501 crore for CGST and ₹71,587 crore for SGST after regular settlement.

- December 2023 revenues are 10.3% higher compared to the same month in 2022.

- Domestic transactions (including import of services) saw a 13% increase in revenue compared to December 2022.

Chart and Tables:

Include the provided chart illustrating monthly gross GST revenue trends and Tables 1 & 2 showcasing state-wise collection and post-settlement revenue figures.

Conclusion:

The robust growth in GST collection is a positive indicator of India’s economic recovery and growth potential. The sustained momentum bodes well for the future of the GST regime and its role in propelling the Indian economy forward.