Struggling with TDS mismatches? The six-year revision cap is hitting businesses hard.

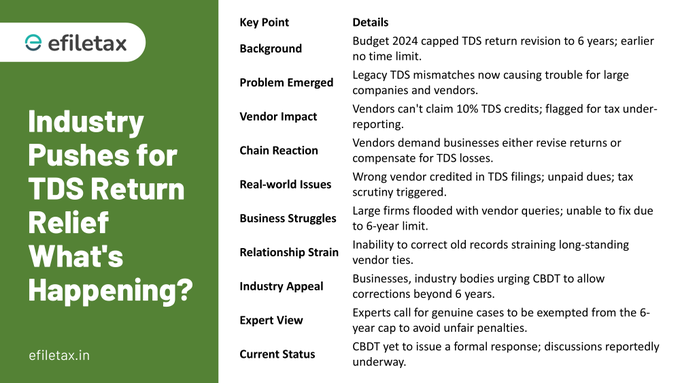

Large Indian industries — e-commerce, banking, IT, healthcare — are now urging the Central Board of Direct Taxes (CBDT) to ease restrictions on TDS return revision. After the Union Budget 2024 capped TDS corrections to six years, businesses are battling serious vendor disputes and compliance risks.

Earlier, TDS returns could be revised anytime. Now, this time-bar is exposing both companies and small vendors to mismatches, tax demands, and strained partnerships.

What Changed?

(Union Budget 2024 Policy Shift)

| Particulars | Earlier Position | Post-July 2024 Change |

|---|---|---|

| TDS Return Revision Window | No Time Limit | Only Past 6 Financial Years |

| Impact | Legacy corrections allowed anytime | Older mismatches now stuck |

Source: Budget 2024, CBDT policy changes

Why is the Industry Upset?

- Legacy mismatches are coming up during tax reconciliations.

- Vendors unable to claim TDS credit, facing tax demands.

- Incorrect TDS reporting causing double jeopardy: both real and wrong vendors suffer.

- Commercial relationships strained over unpaid or wrongly credited TDS amounts.

Legal Angle: What the Law Says

The restriction flows from Section 200 and Rule 31A under the Income-tax Act, 1961 and Income Tax Rules, 1962, which govern TDS statements.

The new six-year limit has tightened the compliance timelines but offers no carve-out for genuine reconciliation errors.

📖 Relevant Notification:

CBDT Notification No. 67/2024 dated 31st July 2024 (effective from AY 2025-26).

Expert View: A Compliance Time Bomb

“Good intent to streamline tax records.

Bad execution causing real vendor hardship.”

— Senior Tax Consultant, Mumbai

Experts highlight that the cap may improve tax administration on paper, but is practically harming small vendors and creating unnecessary litigation risks for large companies.

How Companies are Affected

- Forced to compensate vendors directly for blocked TDS refunds.

- Increase in vendor claims, disputes, and scrutiny notices.

- Higher compliance costs for reconciliation support.

- Dented vendor relationships and credibility loss.

What Relief is Being Demanded?

- Relaxation of six-year cap in genuine hardship cases.

- One-time window to correct past TDS returns.

- Safeguards for small vendors, who otherwise suffer tax credit denials.

Industry bodies are pushing the CBDT to introduce either:

- A conditional relief mechanism (similar to past amnesty schemes); or

- Clear SOPs for handling genuine TDS mismatch cases.

What Should Businesses Do Now?

✅ Proactively review past TDS filings.

✅ Engage vendors in early reconciliation discussions.

✅ Keep documentation ready in case relief is announced.

✅ Consult tax professionals to assess possible exposures.

👉 Need help with TDS filings, corrections, or vendor reconciliation?

efiletax experts are here to guide you!

Quick FAQ

Q1: What is the current limit for revising TDS returns?

A: Only for the past six financial years, as per Budget 2024.

Q2: Can legacy mismatches before six years be corrected?

A: No, unless CBDT announces any specific relaxation.

Q3: What if a vendor’s TDS credit is missing due to old errors?

A: Vendors may not get credit and could face tax demands.

Q4: Will the CBDT allow a one-time correction window?

A: Industry has requested it. CBDT is yet to respond officially.