Recovery of Excess ITC by Proper Officer: Explained

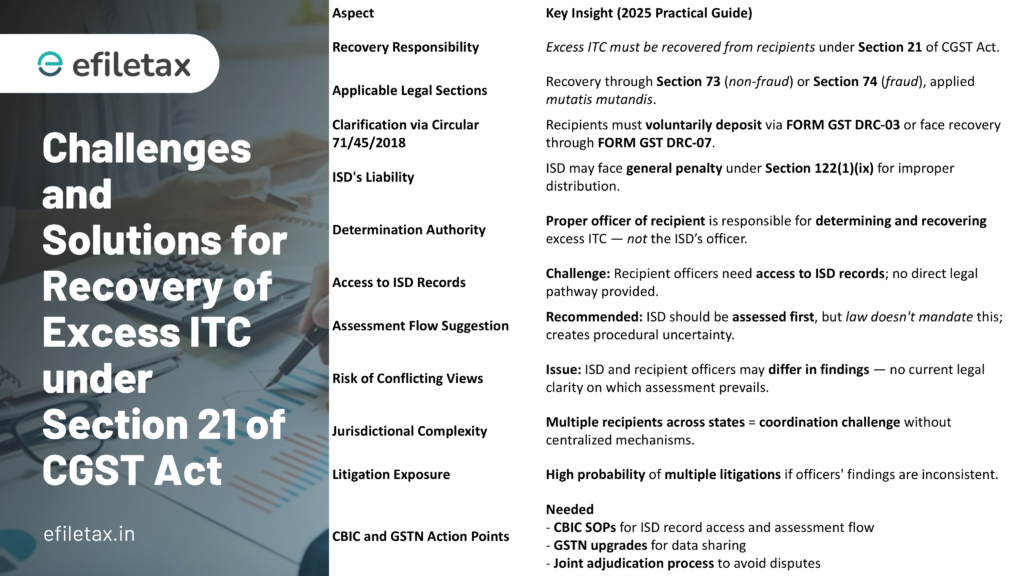

When an Input Service Distributor (ISD) wrongly distributes excess Input Tax Credit (ITC), Section 21 of the CGST Act, 2017 kicks in. The burden of recovery shifts not to the ISD but directly to the recipient units. However, the ground reality is far more complex.

Circular No. 71/45/2018-GST, dated 26th October 2018, gives partial clarity, but many operational challenges remain. Let’s break this down.

Key Legal Provisions on Excess ITC Recovery

- Section 21, CGST Act, 2017:

Recovery of excess ITC must be made from the recipients, not the ISD. - Recovery Modes:

Action to be initiated under Section 73 (non-fraud) or Section 74 (fraud cases). - Penalty on ISD:

ISD may face penalty under Section 122(1)(ix) for wrong distribution of ITC. - Circular No. 71/45/2018-GST Clarifications:

- Voluntary deposit by recipients via DRC-03 is allowed.

- If not deposited, recovery proceedings through DRC-07 can be initiated.

How Will Proper Officer Identify Excess ITC?

The biggest hurdle is evidence access. Two possible methods:

| Approach | Practical Issues |

|---|---|

| 1. Access ISD Records | Officer needs GSTR-6 returns, invoices, ITC distribution sheets. Jurisdictional hurdles arise if ISD and recipient fall under different states. |

| 2. Rely on ISD Assessment | Ideally, ISD’s officer should assess excess ITC first. But law doesn’t mandate it. Leads to inconsistencies. |

Expert View:

Without streamlined GSTN data sharing, independent actions by officers will lead to confusion and litigation.

Can Different Officers Have Different Views?

Yes. Officers of ISD and recipients can differ on the amount of excess ITC.

| Issue | Reality |

|---|---|

| Basis of Dispute | Different interpretations of Section 20 (eligible ITC). |

| Jurisdictional Conflicts | Lack of cross-verification mechanisms. |

| Binding Authority | For recovery, recipient’s officer decision prevails. ISD’s officer’s penalty order is separate. |

Major Practical Challenges in Recovery Process

- Jurisdictional Coordination Failure

No clear system to share ISD records across states. - Delayed Access to Records

Officers often work with incomplete information. - Multiple Litigations Risk

ISD may contest penalties. Recipients may challenge recovery—leading to parallel disputes. - Disproportionate Penalties

ISD and recipients punished differently for the same excess ITC issue.

Recommendations for Smoother Recovery Process

- CBIC Clarification Needed:

- Whether ISD’s assessment is mandatory before recovery from recipients.

- Formal procedure for officers to access ISD’s GSTR-6 data.

- GSTN Portal Improvements:

Enable real-time ISD-recipient data sharing. - Unified Adjudication Mechanism:

Joint proceedings for excess ITC recovery across jurisdictions. - Clear Appellate Guidelines:

How appellate authorities should tackle conflicting recovery and penalty orders.

Quick Summary (Google Snippet Ready)

Recovery of excess ITC by proper officer under GST is riddled with challenges. Jurisdictional issues, lack of ISD record access, and conflicting officer views create confusion. CBIC needs urgent clarifications to streamline processes and reduce litigation risk.

FAQs: Recovery of Excess ITC by Proper Officer

Q1. Who recovers excess ITC distributed by an ISD?

The proper officer of the recipient unit recovers it under Section 21.

Q2. Can the ISD be penalized too?

Yes. Under Section 122(1)(ix), ISD may face a penalty for wrong ITC distribution.

Q3. What happens if the ISD and recipient officers disagree?

Recipient’s officer’s view binds for recovery, but disputes may escalate to appellate forums.

Q4. Can GSTN support easier recovery?

Currently limited, but improvements in data sharing are urgently needed.

Conclusion

The recovery of excess ITC by proper officer under GST is more complex than it appears on paper. Without smooth coordination, businesses may suffer from overlapping penalties and recoveries. For businesses facing ISD-related issues, professional support is crucial.

👉 Need help navigating GST complexities? Talk to our experts at efiletax and stay compliant, stress-free.