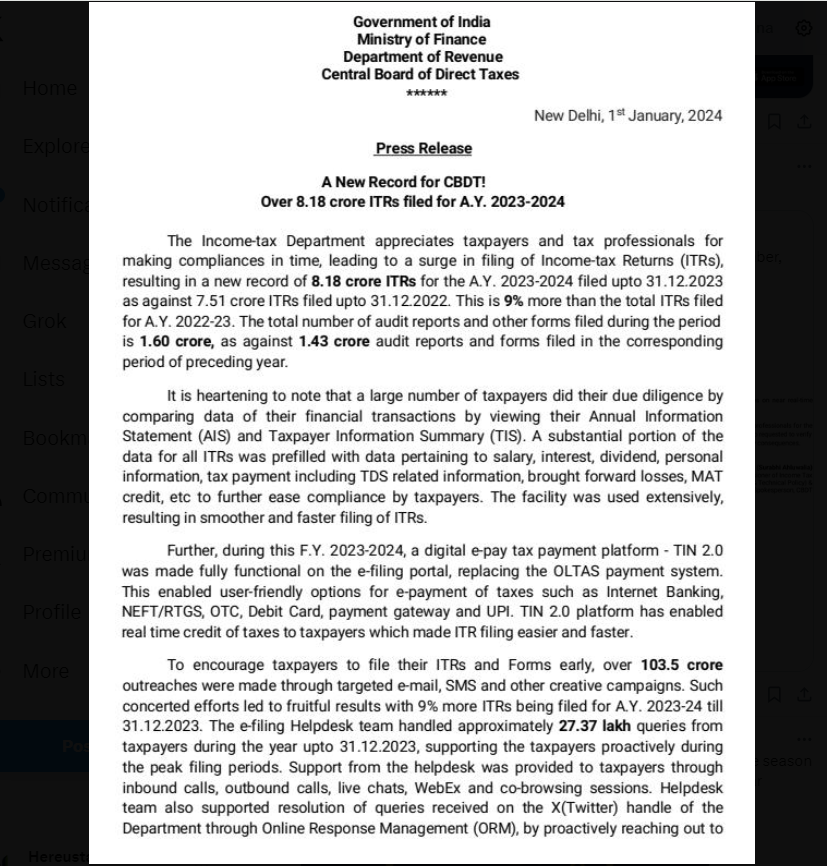

Highlights of Income Tax Return (ITR) Filing for Assessment Year 2023-24:

- Record Filings: 8.18 crore ITRs were filed by December 31, 2023, marking a 9% increase year-on-year.

- Audit Reports: A total of 1.60 crore audit reports and other forms were filed, indicating a comprehensive approach to tax compliance.

- AIS Facility: Extensive use of the AIS facility resulted in smoother and faster filing of ITRs, streamlining the overall process for taxpayers. support@efiletax.in

- TIN 2.0: The digital e-pay tax payment platform, TIN 2.0, facilitated real-time credit of taxes to taxpayers, making ITR filing more accessible and efficient.

- Outreach Campaign: Over 103.5 crore outreaches were conducted through targeted e-mails, SMS, and creative campaigns to encourage early filing of ITRs and Forms, promoting timely compliance.

- e-Filing Helpdesk: The e-filing helpdesk team addressed approximately 27.37 lakh queries from taxpayers, underscoring the department’s commitment to providing support and guidance.

The Department extends gratitude to taxpayers and tax professionals for their support and timely compliance. Taxpayers are encouraged to verify any unverified ITRs within 30 days