On November 25, 2024, the Cabinet Committee on Economic Affairs (CCEA) approved the Income Tax Department’s ambitious PAN 2.0 Project, designed to streamline and modernise the issuance and management of Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN). By integrating existing services into a unified, eco-friendly portal, this initiative aligns with the Digital India vision, promising faster, more efficient processes for taxpayers.

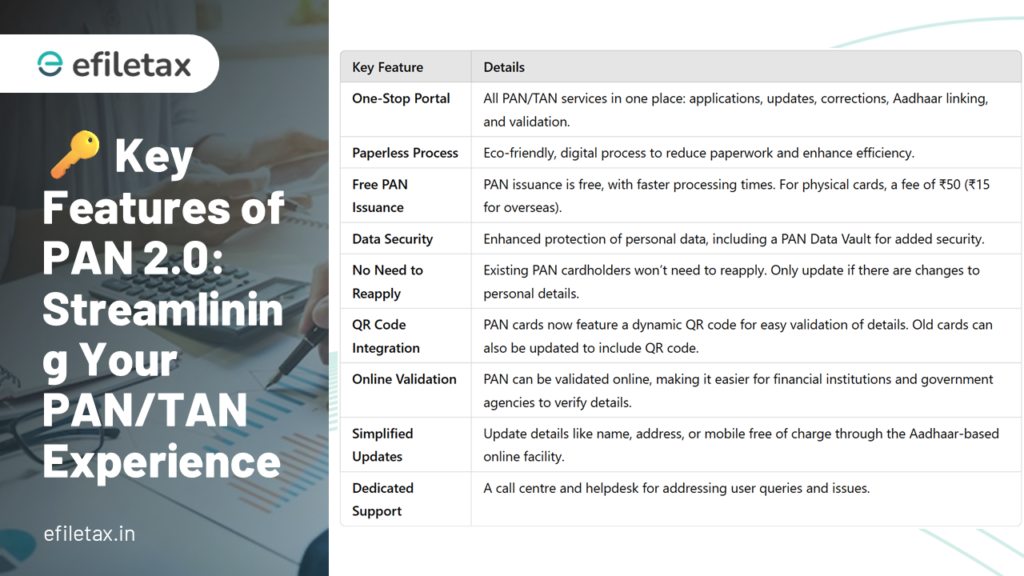

Key Features of PAN 2.0 Project

- Unified Portal:

All PAN and TAN-related services—such as application, updates, corrections, Aadhaar-PAN linking, and grievance redressal—will now be accessible on a single platform. This integration simplifies user navigation and eliminates delays caused by scattered platforms. - Eco-Friendly Processes:

Fully paperless operations reduce environmental impact while cutting processing times. - Enhanced Data Security:

A PAN Data Vault ensures personal and demographic information remains secure, adhering to global data protection standards. - Faster, Free PAN Services:

Applications, corrections, and updates are free of cost for taxpayers. A fee of ₹50 applies only for physical PAN card issuance. - Dynamic QR Code:

Newly issued PAN cards will include an enhanced QR code, reflecting real-time updates to PAN data. - Dedicated Call Centre:

A helpline ensures immediate support for user queries and grievances.

Significance of PAN 2.0

The project consolidates services previously managed across three portals—e-Filing, UTIITSL, and Protean e-Gov—into a single platform. It resolves common challenges such as:

- Delayed updates and grievance redressals.

- Duplication of PANs due to scattered systems.

- Time-consuming corrections and re-issuance processes.

Furthermore, PAN will serve as a common identifier for all digital systems used by specified government agencies, strengthening its utility in sectors like banking, government filings, and regulatory compliance.

Implications for Taxpayers

- Existing PAN Holders: No action is required unless updates or corrections are needed. All existing PAN cards remain valid under the new system.

- Multiple PANs: Systems will now detect and deactivate duplicate PANs to ensure compliance with the Income Tax Act, 1961.

- Global Access: Taxpayers can update or reprint their PAN cards from anywhere, with nominal delivery charges for international locations.

Case Law Insights

The Madhya Pradesh High Court’s recent ruling on the importance of proper communication in PAN cancellations underscores the need for streamlined grievance redressal, which PAN 2.0 directly addresses. By centralising processes and improving transparency, the project strengthens taxpayer rights while reducing the risk of compliance errors.

How PAN 2.0 Aligns with Digital India

The project not only simplifies taxpayer interactions but also advances India’s digital infrastructure. By focusing on automation, secure data handling, and eco-friendly practices, PAN 2.0 is a pivotal step toward achieving e-governance goals.

FAQ Section

| Question | Answer |

|---|---|

| What is PAN 2.0? | An e-Governance project consolidating all PAN/TAN services on a single, unified portal. |

| Do I need to reapply for PAN? | No, existing PAN cards remain valid unless corrections or updates are required. |

| What about QR code updates? | New PAN cards will include an enhanced QR code with dynamic updates, available upon request. |

| Is the process fully paperless? | Yes, PAN 2.0 offers a complete paperless process for applications, corrections, and updates. |

| How are duplicate PANs handled? | Advanced systems detect duplicates, ensuring compliance with the Income Tax Act, 1961. |

Conclusion

The PAN 2.0 Project transforms PAN and TAN management, offering faster, eco-friendly, and user-centric services. As a cornerstone of the Digital India initiative, this upgrade empowers taxpayers while setting a new benchmark for e-governance.