October 2024 saw Goods and Services Tax (GST) collections in India reach Rs 1.87 lakh crore, reflecting an 8.9% year-on-year growth compared to the same month in 2023. While these collections stayed above Rs 1.7 lakh crore for the eighth consecutive month, they also marked a six-month high, showcasing resilience in India’s economic activity amid ongoing global uncertainties. Let’s dive deeper into the numbers and understand the broader trends.

GST Collection Insights for October 2024

The gross GST revenue for October 2024 was Rs 1.87 lakh crore, compared to Rs 1.72 lakh crore in October 2023, representing a year-on-year growth of 8.9%. The cumulative GST collection for 2024 has grown by 9.4% to reach Rs 12.74 lakh crore so far, indicating strong domestic economic performance. This growth is largely fueled by festive spending and an overall improvement in compliance measures by tax authorities.

It’s also worth noting that GST collections for the month of October were 8.1% higher sequentially from September 2024, which had seen a dip in collections due to a cooling-off period post the end of the monsoon season. The October uptick has been partially attributed to the increase in festive spending, especially in the automobile sector and consumer goods.

Breakdown of Domestic and Import Revenues

The gross domestic GST revenues for October 2024 saw a growth rate of 10.6% compared to the previous year. In contrast, GST revenues from imports grew by a modest 3.9%. The stronger domestic performance reflects increased consumption during the festive season, which traditionally witnesses a spike in purchases across various sectors.

Refunds for October 2024 were also higher than last year, with domestic refunds increasing by 42.8% to Rs 10,498 crore and total refunds rising by 18.2%. The substantial rise in domestic refunds signals an improvement in the efficiency of GST processing, which benefits businesses by maintaining liquidity.

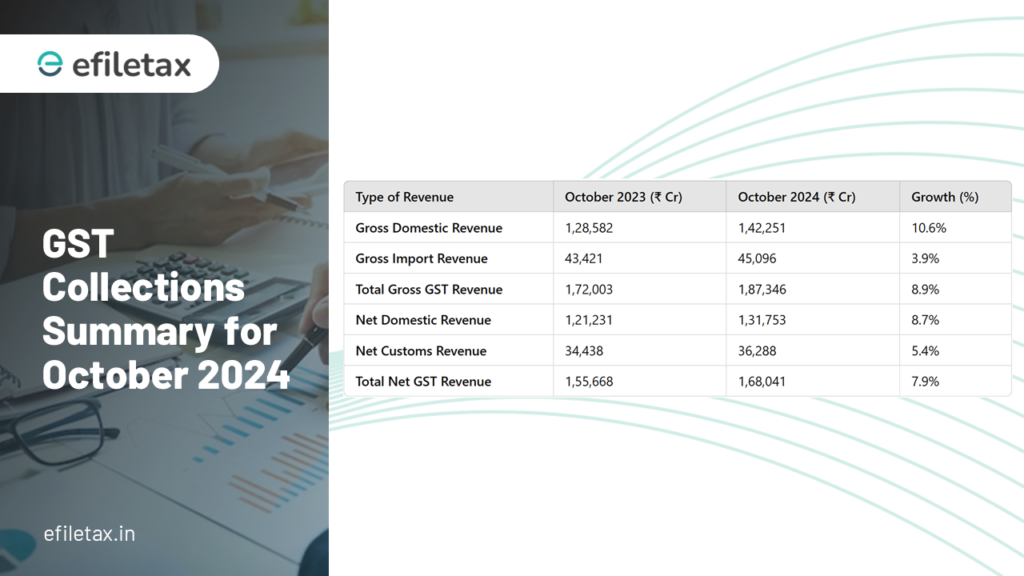

GST Gross and Net Collections (Amount in Crores) – October 2024

| Revenue Type | October 2023 (Rs Cr) | October 2024 (Rs Cr) | % Growth |

|---|---|---|---|

| Gross Domestic Revenue | 1,28,582 | 1,42,251 | 10.6% |

| Gross Import Revenue | 43,421 | 45,096 | 3.9% |

| Total Gross GST Revenue | 1,72,003 | 1,87,346 | 8.9% |

| Net Domestic Revenue | 1,21,231 | 1,31,753 | 8.7% |

| Net Customs Revenue | 34,438 | 36,288 | 5.4% |

| Total Net GST Revenue | 1,55,668 | 1,68,041 | 7.9% |

State-wise Growth of GST Revenues during October 2024

| State/UT | October 2023 (Rs Cr) | October 2024 (Rs Cr) | Growth (%) |

| Jammu and Kashmir | 593 | 608 | 2% |

| Himachal Pradesh | 885 | 867 | -2% |

| Punjab | 1,981 | 2,211 | 12% |

| Chandigarh | 210 | 243 | 16% |

| Uttarakhand | 1,834 | 1,834 | 0% |

| Haryana | 8,716 | 10,045 | 15% |

| Delhi | 7,754 | 8,660 | 12% |

| Rajasthan | 4,046 | 4,469 | 10% |

| Uttar Pradesh | 8,964 | 9,602 | 7% |

| Bihar | 1,406 | 1,604 | 14% |

| Kerala | 2,418 | 2,896 | 20% |

| Maharashtra | 27,309 | 31,030 | 14% |

| Karnataka | 11,971 | 13,081 | 9% |

| Tamil Nadu | 10,761 | 11,188 | 4% |

| West Bengal | 4,853 | 5,597 | 15% |

| Gujarat | 9,730 | 11,407 | 17% |

SGST & SGST Portion of IGST Settled to States/UTs till October 2024

| State/UT | Pre-Settlement SGST (2023-24) (Rs Cr) | Pre-Settlement SGST (2024-25) (Rs Cr) | Post-Settlement SGST (2023-24) (Rs Cr) | Post-Settlement SGST (2024-25) (Rs Cr) | Growth (%) |

| Jammu and Kashmir | 1,762 | 1,765 | 4,817 | 5,143 | 7% |

| Himachal Pradesh | 1,546 | 1,597 | 3,302 | 3,603 | 9% |

| Punjab | 4,903 | 5,342 | 13,115 | 13,551 | 3% |

| Haryana | 11,637 | 13,472 | 20,358 | 22,973 | 13% |

| Delhi | 9,064 | 10,415 | 18,598 | 20,902 | 12% |

| Rajasthan | 9,859 | 10,418 | 22,571 | 24,541 | 9% |

| Uttar Pradesh | 18,880 | 20,508 | 42,482 | 48,733 | 15% |

| Gujarat | 24,005 | 25,898 | 36,322 | 41,439 | 14% |

| Maharashtra | 58,057 | 64,324 | 84,712 | 96,724 | 14% |

| Tamil Nadu | 23,661 | 26,359 | 37,476 | 44,744 | 19% |

State Wise/Approving Authority wise Domestic Collection (April 2024 to October 2024)

| State/UT | CGST (Rs Cr) | SGST (Rs Cr) | IGST (Rs Cr) | CESS (Rs Cr) | Total (Rs Cr) |

| Jammu and Kashmir | 446 | 673 | 667 | 29 | 1,814 |

| Himachal Pradesh | 501 | 692 | 1,448 | 8 | 2,649 |

| Punjab | 1,608 | 2,419 | 2,557 | 162 | 6,746 |

| Chandigarh | 151 | 196 | 421 | 4 | 773 |

| Uttarakhand | 1,033 | 1,577 | 2,819 | 16 | 5,445 |

| Haryana | 4,371 | 5,714 | 21,208 | 415 | 31,707 |

| Delhi | 3,512 | 4,098 | 9,386 | 645 | 17,641 |

| Rajasthan | 3,490 | 4,511 | 5,449 | 787 | 14,235 |

| Uttar Pradesh | 7,166 | 9,530 | 10,432 | 5,622 | 32,746 |

| Bihar | 1,330 | 2,181 | 917 | 1,151 | 5,579 |

| Gujarat | 8,965 | 10,755 | 11,696 | 2,238 | 33,654 |

| Maharashtra | 24,381 | 28,616 | 32,842 | 10,896 | 96,735 |

| Karnataka | 9,753 | 12,115 | 19,109 | 5,506 | 46,485 |

| Tamil Nadu | 8,622 | 10,957 | 11,439 | 5,096 | 36,115 |

| Telangana | 4,571 | 5,599 | 4,896 | 2,662 | 17,729 |

Expert Analysis

Saurabh Agarwal, Tax Partner at EY, commented on the October collections, stating, “The increase in GST collections during October indicates a cautious but positive economic trajectory for India. While the growth remains in single digits, it reflects a cooling-off phase following a year of surging consumer spending. The festive season collections will be a key indicator of short-term economic trends.”

The relatively moderate growth in GST revenues compared to the peak periods of the previous fiscal year may suggest a slowdown in consumer spending. However, the resilience in October’s numbers also suggests that the economy continues to hold strong amidst potential global economic challenges.

Conclusions and Future Outlook

The October GST collections indicate a stable economic outlook for India, driven largely by domestic demand and effective tax compliance. While the growth in collections is slightly lower than peak periods earlier in the year, the consistent rise month-on-month points to economic resilience. The festive season has played a key role in driving October collections, and the coming months will reveal whether this momentum can be maintained.

For businesses and individuals, it’s important to stay updated with such trends as they often indicate policy changes and economic health. At Efiletax, we ensure our clients are always informed and prepared. Contact us today for expert advice and GST compliance assistance.

Need Help with Your GST Compliance?

If you’re facing issues with GST filing or require assistance in understanding the latest regulations, Efiletax’s expert team is here to help. Reach out today and stay compliant effortlessly.