The Central Board of Direct Taxes (CBDT) has notified revised Income Tax Return forms for Assessment Year 2025–26, corresponding to Financial Year 2024–25, through Notifications No. 40–42/2025. These changes affect ITR-1, ITR-3, ITR-4, and ITR-5. This blog breaks down the latest updates and how they impact compliance for salaried taxpayers, business owners, and professionals.

ITR-1 (Sahaj): Simplified Yet Stricter

Key Highlights

- Eligibility: Resident individuals (excluding Not Ordinarily Residents) with total income up to ₹50 lakh from salary, one house property, other sources, and agriculture income up to ₹5,000.

- New Allowance: Long-term capital gains (LTCG) under Section 112A up to ₹1.25 lakh now allowed in ITR-1. Previously disallowed.

- Capital Gains Check: If LTCG exceeds ₹1.25 lakh, or if there’s short-term capital gain/loss, ITR-1 cannot be used.

- New Tax Regime Opt-Out: If opting out of Section 115BAC in AY 2025–26, Form 10-IEA must be filed. ITR-1 now requires reporting of the acknowledgement number and filing date of Form 10-IEA.

- Deductions: Sections 80C to 80U now require dropdown-based structured inputs. Free-text inputs discontinued.

- Bank Details: All Indian bank accounts (except dormant ones) must be disclosed. One active account is mandatory for refund.

- Schedule AL: Now applies only if total income exceeds ₹1 crore (up from ₹50 lakh).

ITR-4 (Sugam): Presumptive Tax Simplified

What’s New

- Who Can File: Resident Individuals, HUFs, Firms (excluding LLPs) with income up to ₹50 lakh under Sections 44AD, 44ADA, or 44AE.

- LTCG Inclusion: LTCG under Section 112A up to ₹1.25 lakh permitted.

- Presumptive Limits Increased:

- Section 44AD (Business): ₹3 crore if ≥95% receipts are digital

- Section 44ADA (Profession): ₹75 lakh if ≥95% receipts are digital

- Form 10-IEA: Mandatory if opting out of new regime.

- Foreign Retirement Funds: Section 89A disclosures added.

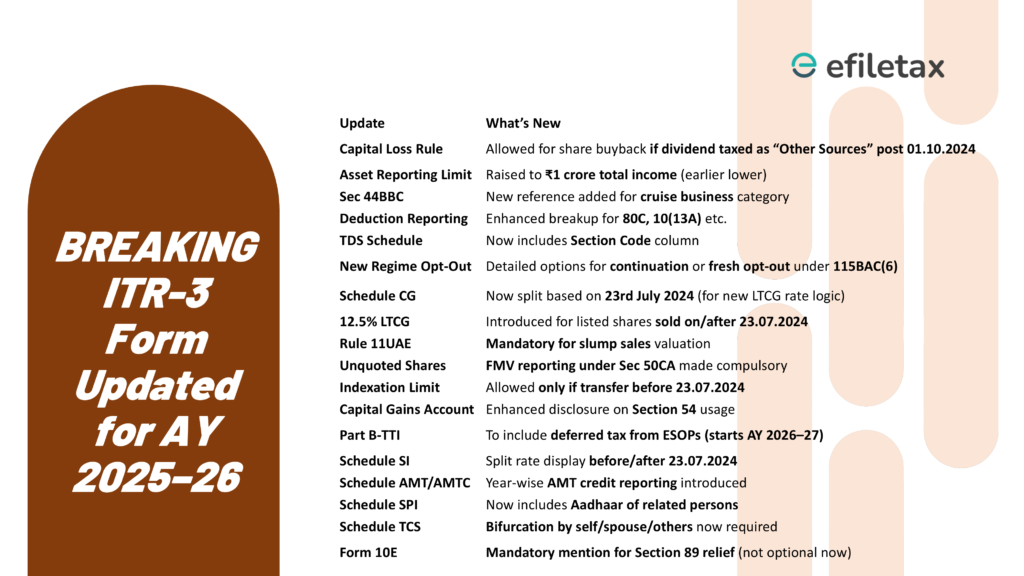

ITR-3: Capital Gains and Compliance

Major Overhaul

- Capital Gains Split: Gains now split into “before” and “on/after” 23 July 2024, as per new 12.5% tax rate under Finance Act, 2024.

- Buyback Loss Allowed: Only if related dividend income is declared as ‘Income from Other Sources’, applicable post 01.10.2024.

- Schedule AMT/AMTC: Detailed tracking for tax credit under Section 115JD.

- Verification Updates: Expanded declaration options for representative capacity.

- PAN/Aadhaar for Clubbing: Required in Schedule SPI.

- Foreign Assets & Retirement Accounts: Additional compliance checks included.

ITR-5: What Businesses Must Note

New Sections and Compliance

- Schedule-CG Bifurcation: Required for capital gains before and after 23 July 2024.

- Buyback Rule Applied: Same dividend declaration rule for buyback loss as ITR-3.

- Section 44BBC Introduced: Cruise business under presumptive tax now recognised.

- TDS/TCS Schedules: Now require section code for every deduction or collection.

Legal & Expert Takeaway

These ITR changes are not cosmetic—they reflect deeper shifts in tax policy post Budget 2024. The government is tightening validation, aligning reporting with AI-driven CPC scrutiny, and preparing for smoother enforcement.

Expert Tip: File Form 10-IEA on time if you’re opting out of the new tax regime. Miss it, and you might lose the old regime benefits permanently.

CBDT notifies new ITR forms for AY 2025–26. Key updates in ITR-1 to ITR-5 include capital gains split, LTCG in ITR-1/4, revised deduction formats, new tax regime disclosures, and stricter audit trails.

Call to Action

Stay compliant with the latest tax changes. Need help filing under the updated ITR forms? Visit efiletax.in or contact our experts for guided assistance.

Optional FAQ Section

Q1. Can I file ITR-1 if I have LTCG under Section 112A?

Yes, up to ₹1.25 lakh is now allowed under AY 2025–26.

Q2. What if I forget to file Form 10-IEA?

You may be forced into the new tax regime for the year. File it before the due date under Section 139(1).

Q3. Is capital gains split applicable to all ITRs?

No, only ITR-3 and ITR-5 currently implement this bifurcation.

Q4. Are deductions still manually entered?

No, AY 2025–26 requires dropdown-based structured inputs.

Q5. Do I need to report all bank accounts?

Yes, except dormant accounts. One active account is mandatory for refunds.