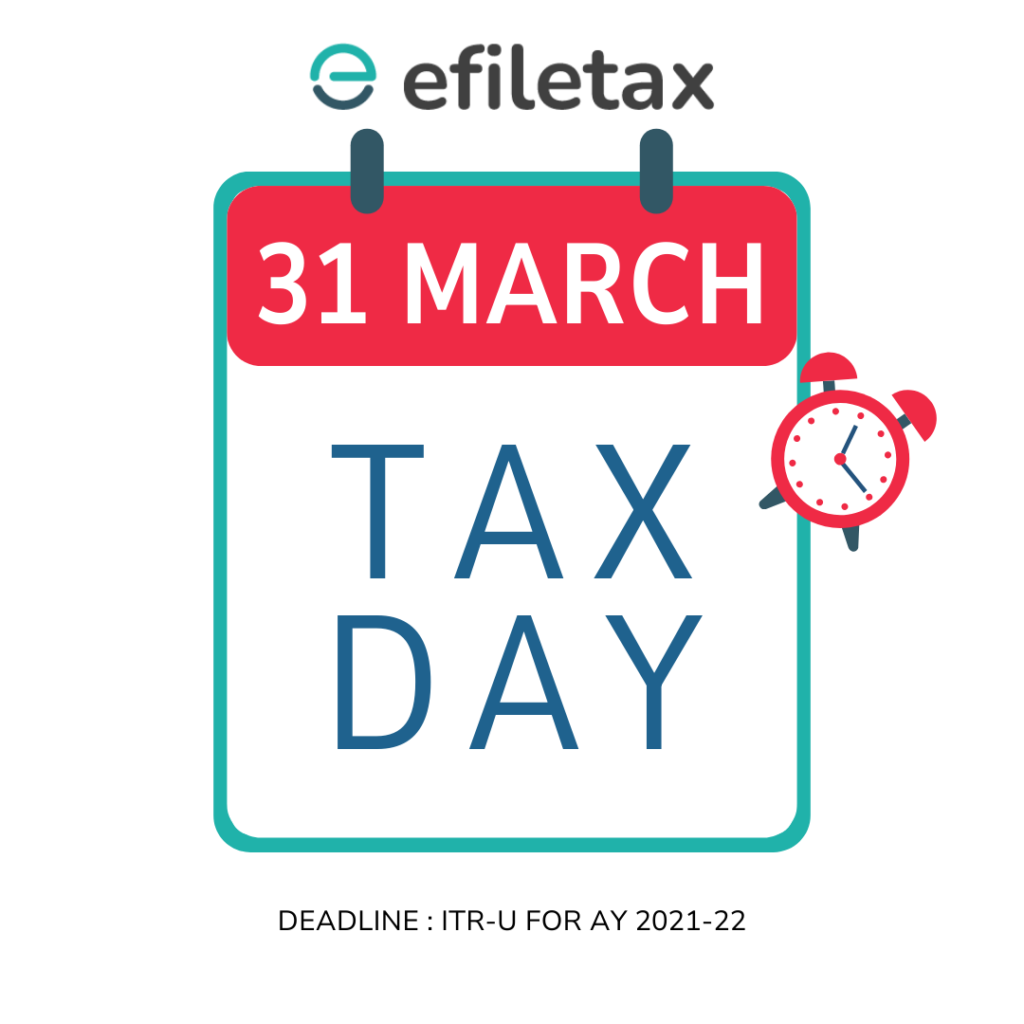

In the ever-evolving landscape of tax regulations, staying informed about the latest updates is crucial for taxpayers. For the Assessment Year (AY) 2021-22, significant updates have been made to the Income Tax Return-U (ITR-U) filing requirements. With the deadline looming on March 31, 2024, understanding these changes is key to ensuring compliance and avoiding any last-minute hassles.

Understanding ITR-U Updates for AY 2021-22

The Income Tax Department has introduced several amendments aimed at simplifying the tax filing process while enhancing transparency and compliance. These updates affect various aspects of the ITR-U filing, from documentation to submission procedures. Taxpayers need to pay close attention to these changes to make informed decisions regarding their tax filings.

Key Highlights of the ITR-U Updates

- Revision Opportunities: One of the significant changes includes the provision for taxpayers to revise their returns. This update aims to accommodate inadvertent omissions or errors in the original tax filings.

- Deadline and Penalties: The deadline for submitting the updated ITR-U for AY 2021-22 is set for March 31, 2024. Failing to adhere to this deadline could result in penalties, underscoring the importance of timely compliance.

- Document Requirements: With the new updates, there’s an emphasis on the documentation process. Taxpayers must ensure that all required documents are accurately prepared and submitted to avoid any discrepancies.

How to Prepare for the ITR-U Filing

Preparing for the ITR-U filing involves a thorough review of your financial transactions throughout the fiscal year. It’s advisable to consult with tax professionals or utilize trusted online resources to navigate the updates successfully. Additionally, leveraging technology can streamline the tax filing process, making it more efficient and less prone to errors.

Conclusion: Embrace the Updates with Confidence

The ITR-U updates for AY 2021-22 reflect the government’s commitment to making the tax filing process more user-friendly and compliant. By understanding these changes and preparing accordingly, taxpayers can ensure a smooth filing experience. Remember, the key to successful tax filing lies in early preparation and staying informed about the latest tax regulations.