Last Day to File Belated Income Tax Return for AY 2024-25 🕒

The deadline to file your belated or revised Income Tax Return (ITR) for the Assessment Year (AY) 2024-25 is January 15, 2025. This extension, announced by the Central Board of Direct Taxes (CBDT), gives resident individuals more time to file their returns. Missing this deadline could lead to penalties, interest charges, and the loss of certain tax benefits like deductions and exemptions.

If you haven’t filed your ITR yet or need to revise it, here’s everything you need to know about the process and why you should act immediately.

Why File Before the Deadline?

- Avoid Penalties: Filing after January 15, 2025, attracts late filing fees under Section 234F, up to ₹10,000, depending on your income.

- Interest on Tax Dues: Interest under Sections 234A and 234B is charged for any unpaid taxes.

- Loss of Deductions: Certain benefits like deductions under Chapter VI-A (e.g., Section 80C, 80D) may not be available if you miss the deadline.

- Compliance with Tax Laws: Filing on time ensures you stay compliant and avoid legal notices.

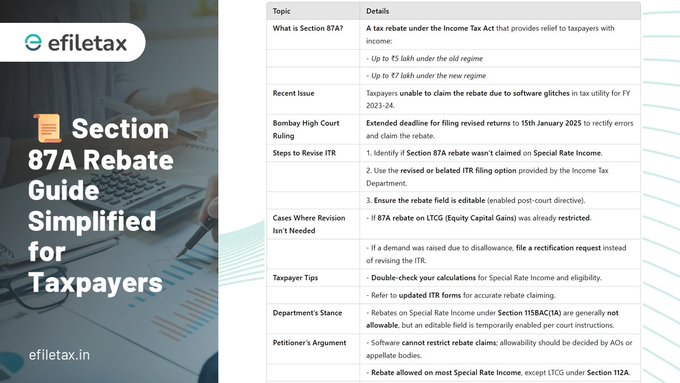

Section 87A Rebate on Special Rate Income

A hot topic for taxpayers this year is the Section 87A rebate on special rate income. The Bombay High Court recently heard a case regarding whether this rebate applies to special rate incomes under Section 115BAC(1A).

Key Highlights from the Case

- Department’s Stand: The rebate is not applicable on special rate income except for specific cases like long-term capital gains (LTCG) under Section 112A.

- Editable Claim Field: Following a court order, the ITR utility enabled taxpayers to claim the rebate, but the department maintained its disagreement.

- Taxpayer’s Argument:The ITR filing utility should not restrict claiming of benefits. The Assessing Officer (AO) should decide the allowability.

💡 Action Required: If you’re eligible for the 87A rebate and it hasn’t been claimed, revise your ITR today. Ensure the claim is accurate to avoid future complications.

Steps to File Your Belated or Revised ITR

- Gather Documents:Form 16 (for salaried employees) Interest certificates Proof of deductions (e.g., 80C investments, 80D premiums)

- Log in to the Income Tax Portal: Visit Income Tax Department’s e-filing portal and log in to your account.

- Select the Appropriate ITR Form: Choose the correct ITR form based on your income type and sources.

- Revise or File Belated ITR:For belated returns, select the filing type as “Belated Return.” For revisions, ensure you make necessary corrections to your original return.

- Verify the ITR: Complete the e-verification process via Aadhaar OTP, net banking, or offline submission of ITR-V.

Special Considerations for Section 87A

If your ITR involves special rate income, review the following:

- ITRs Requiring Revision: Only revise returns where the Section 87A rebate hasn’t been claimed.

- Avoid Errors: Don’t revise ITRs where the rebate was claimed but not allowed by CPC. Wait for rectification.

The deadline to file your belated or revised ITR for AY 2024-25 is fast approaching. Missing it could result in financial penalties and missed tax-saving opportunities. Ensure you revise your ITR today, especially if you’re affected by the Section 87A rebate issue.

🚨 Act Now! Visit the Income Tax Department e-filing portal and file before the clock runs out.

Need help with your taxes?

Let efiletax simplify the process for you. Our experts are here to guide you with filing, revisions, and maximising your tax benefits.