GST Filing Deadline Extensions: January 2025 Update

The Central Board of Indirect Taxes and Customs (CBIC) has issued two critical notifications extending GST filing deadlines for the month of January 2025. These changes apply to GSTR-1 and GSTR-3B returns for various taxpayers across India. Here’s a breakdown of the updated deadlines:

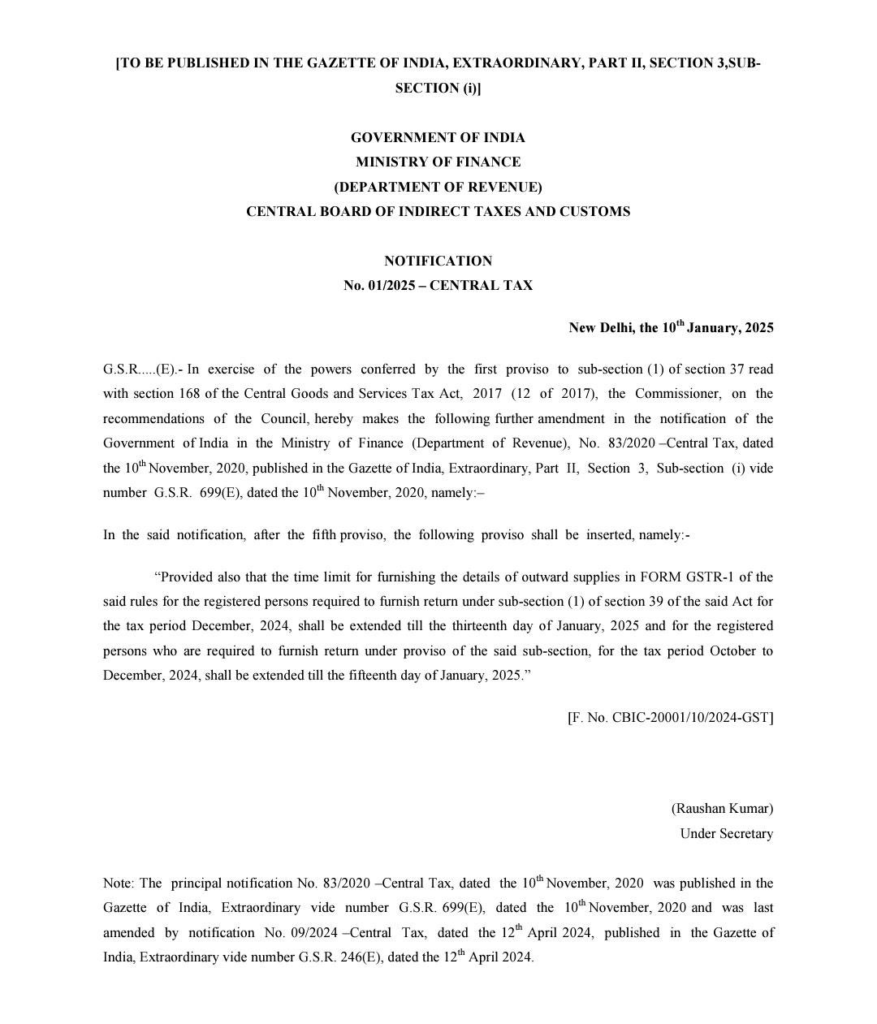

Updated Deadlines for GSTR-1

- Monthly GSTR-1: For taxpayers filing monthly GSTR-1 returns, the deadline for the December 2024 tax period is now extended to 13th January 2025.

- Quarterly GSTR-1: Taxpayers filing quarterly GSTR-1 returns for the October-December 2024 period can submit their returns by 15th January 2025.

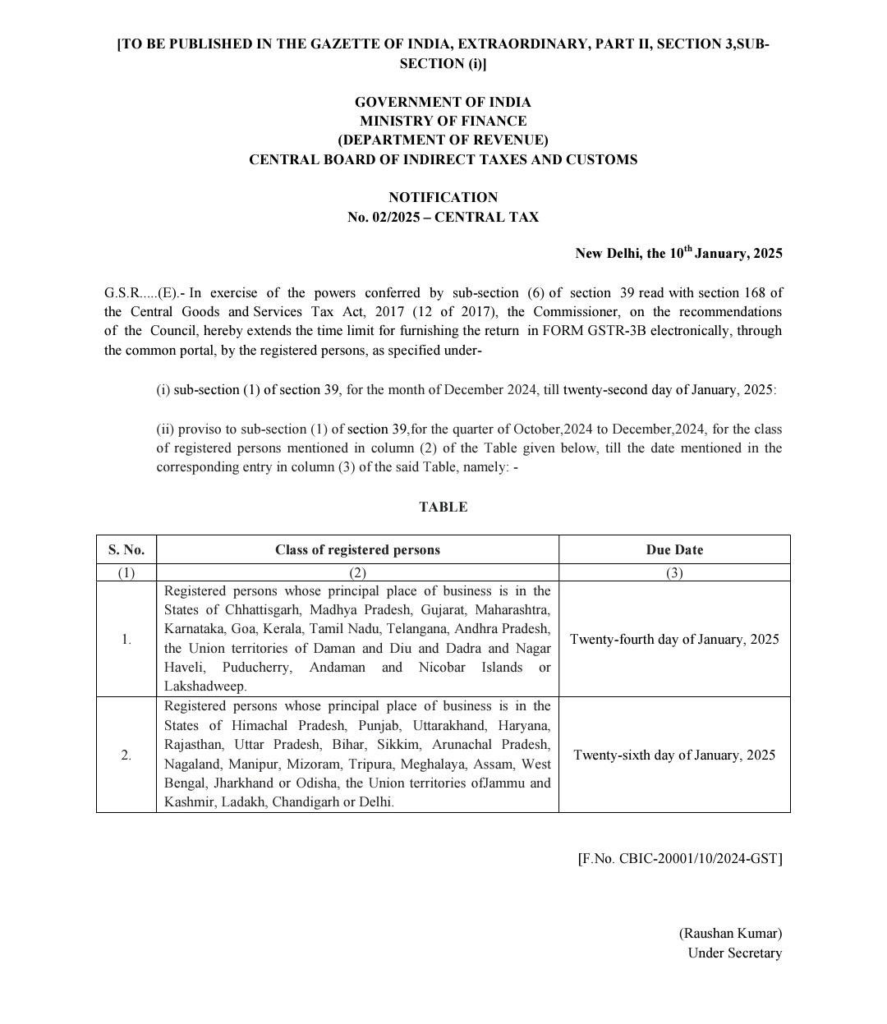

Updated Deadlines for GSTR-3B

- Monthly GSTR-3B: For taxpayers filing monthly GSTR-3B returns, the deadline for the December 2024 tax period has been extended to 22nd January 2025.

- Quarterly GSTR-3B: For taxpayers filing quarterly GSTR-3B returns, the deadlines are as follows:

- Group A States: 24th January 2025.

- Group B States: 26th January 2025.

State-Wise Classification for Quarterly GSTR-3B Deadlines

Group A States:

- Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, and Union Territories of Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands, and Lakshadweep.

Group B States:

- Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, and Union Territories of Jammu and Kashmir, Ladakh, Chandigarh, and Delhi.

Why the Extensions Matter

These deadline extensions provide additional time for taxpayers to ensure compliance and accuracy in their GST filings. Delays or errors in filings could lead to penalties or interest, so it’s crucial to adhere to these updated dates.

Practical Tips for Taxpayers

- Mark Your Calendar: Update your schedules to reflect the revised deadlines.

- Use Technology: Leverage GST filing software or platforms like Efiletax.in to ensure timely and accurate submissions.

- Avoid Last-Minute Filing: File returns early to avoid technical glitches or portal overload.