ITR Filing Due Date Extended for AY 2025–26

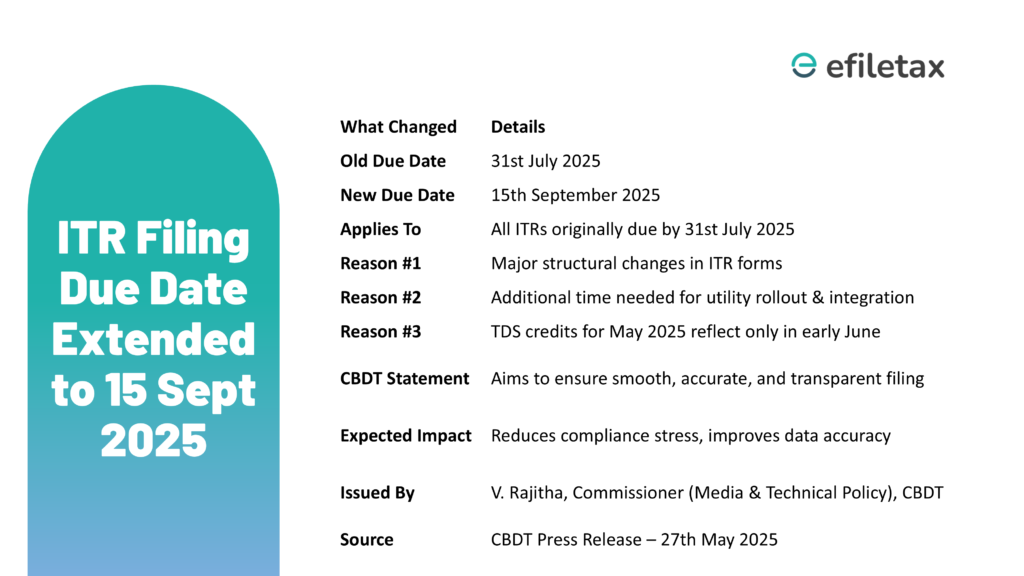

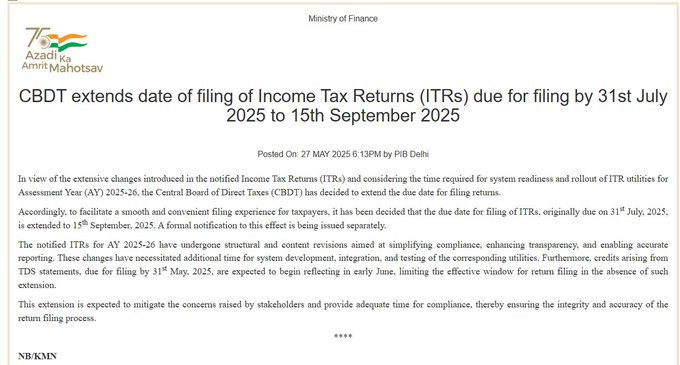

The Income Tax Return (ITR) filing due date for AY 2025–26 has been extended to 15th September 2025. The Central Board of Direct Taxes (CBDT) officially announced this extension on 27th May 2025 via a press release, citing major changes in the ITR forms and delays in utility rollout as the primary reasons.

Why Was the ITR Due Date Extended?

The extension was driven by several practical and technical challenges:

- Structural changes in ITR forms: The notified ITRs for AY 2025–26 have been revised significantly to enhance accuracy and compliance.

- Delayed system readiness: The ITR filing utility software is still being developed and tested, delaying public access.

- TDS credits timeline: Form 26AS and TDS credits, based on TDS returns due by 31st May 2025, typically reflect only by early June.

- Short effective window: Without this extension, taxpayers would have had a limited time frame to file accurate returns.

📌 CBDT’s decision aims to ensure a smoother filing experience for millions of taxpayers and professionals.

Official Reference

This extension was announced by the Press Information Bureau (PIB) on behalf of CBDT. The official update is available at:

🔗 PIB Notification on ITR Due Date Extension

What Does This Mean for You?

For Individual Taxpayers:

- You now have 45 extra days to file your ITR.

- Ensure all TDS credits are correctly reflected in Form 26AS before filing.

- Avoid last-minute rush — use this time to reconcile income and deductions.

For CA Firms & Consultants:

- Plan audits, reconciliations, and filing schedules with the new timeline in mind.

- Anticipate possible client overload near the new due date — stagger your work accordingly.

For Businesses:

- Use this time to finalise books of accounts and review tax-saving opportunities.

Will Tax Audit Date Also Be Extended?

As of now, the tax audit deadline remains unchanged at 30th September 2025.

This gap has raised concerns within the professional community. If no extension is granted for tax audit reports (TAR), businesses and tax professionals may still face time pressure.

📣 CBDT is yet to clarify whether the audit date will be revised. We recommend staying alert for updates.

CBDT has extended the ITR filing due date for AY 2025–26 from 31st July to 15th September 2025 due to revised ITR formats and utility delays. Taxpayers get more time to file accurately, but clarity on the tax audit deadline is still awaited. Formal notification expected shortly.

FAQs

Q1. Is this extension applicable to all taxpayers?

Yes, the extension to 15th September 2025 applies to all taxpayers who were originally required to file ITR by 31st July 2025.

Q2. Has the tax audit deadline also been extended?

No update yet. The tax audit due date remains 30th September 2025 as per current provisions.

Q3. Do I need to wait for Form 26AS updates before filing?

Yes, it is advisable to wait until TDS credits reflect accurately in Form 26AS and AIS to ensure error-free filing.