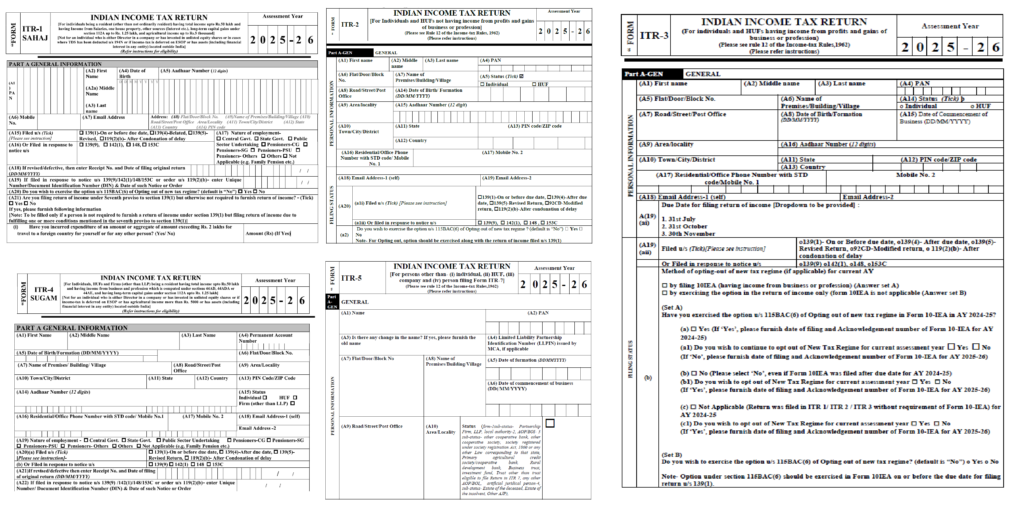

CBDT has officially notified the revised Income Tax Return (ITR) forms from ITR-1 to ITR-5 for AY 2025–26, applicable for income earned during FY 2024–25. These forms were released via Notifications No. 40/2025 to 43/2025 dated between 29 April and 3 May 2025, amending Rule 12 of the Income-tax Rules, 1962.

Let’s break down what’s changed and who should file which ITR form this year.

✅ Key Highlights Across Forms

- Split Capital Gains reporting for transactions before/after 23.07.2024 (post-Finance Act, 2024).

- Buyback loss now allowed only if related dividend income is shown as “income from other sources”.

- TDS Section Code reporting made mandatory in Schedule-TDS.

- Asset and liability threshold increased to ₹1 crore of total income.

- Deductions now reported in more granular detail (like 80C, 10(13A), 80CCD).

📘 ITR-1 (Sahaj): For Salaried Individuals

Eligibility:

- Resident individuals (not Ordinarily Resident)

- Total income up to ₹50 lakh

- Income from salary, one house property, other sources (like interest), and LTCG up to ₹1.25 lakh under section 112A

- Agricultural income up to ₹5,000

Not eligible if:

- Director in a company

- Holding unlisted shares

- Foreign assets/income

What’s New:

- New checkbox for opting out of new tax regime u/s 115BAC(6)

- Foreign travel expense disclosure if return filed under Seventh Proviso to Sec 139(1)

📘 ITR-2: For Capital Gains & Foreign Asset Holders

Eligibility:

- Individuals/HUFs not having income from business or profession

- Includes those with capital gains, multiple properties, foreign assets, dividend income

Key Changes:

- Capital gain bifurcation (before/after 23.07.2024)

- Share buyback loss conditionally allowed (post 01.10.2024)

- Detailed deduction fields for 80C, 10(13A)

- Revised Schedule-TDS with mandatory section codes

📘 ITR-3: For Business/Professional Income

Eligibility:

- Individuals/HUFs earning from proprietary business or profession

What’s New:

- Same capital gains split and buyback rules

- Addition of Section 44BBC (presumptive taxation for cruise business)

- TDS code field added

- Enhanced AL (Assets & Liabilities) reporting

📘 ITR-4 (Sugam): For Presumptive Income

Eligibility:

- Resident Individuals, HUFs, and Firms (other than LLPs)

- Income under presumptive schemes u/s 44AD, 44ADA, 44AE

What’s New:

- Allowed to file even with LTCG up to ₹1.25 lakh under 112A, provided no carry-forward of loss

- New deduction reporting fields for 80CCD(1), 80E, 80EEA

- Schedule TDS/TCS revised for section code mapping

📘 ITR-5: For Firms, LLPs, AOPs, BOIs

Eligibility:

- Firms, LLPs, AOPs, BOIs, and others (not individual/HUF)

What’s New:

- Same capital gain breakup

- Section 44BBC added

- Buyback loss allowed only with corresponding dividend income

- TDS section code field included

📌 Important Notifications:

Notification No. 40/2025 – ITR-1 & ITR-4

Notification No. 43/2025 – ITR-2

Notification No. 41/2025 – ITR-3

Notification No. 42/2025 – ITR-5

Download the PDFs

Want to view the forms? Access ITR-1 to ITR-5 PDF copies directly from our portal or the Income Tax e-Filing website.

⚠️ Final Advice from EfileTax

Choosing the right ITR form is not just a compliance formality—it impacts refund speed, avoids scrutiny, and ensures smooth processing. With so many structural changes this year, file with caution or get help from a tax expert.

Need help selecting your ITR form? Contact us at efiletax.in or DM us on X @efile_tax.