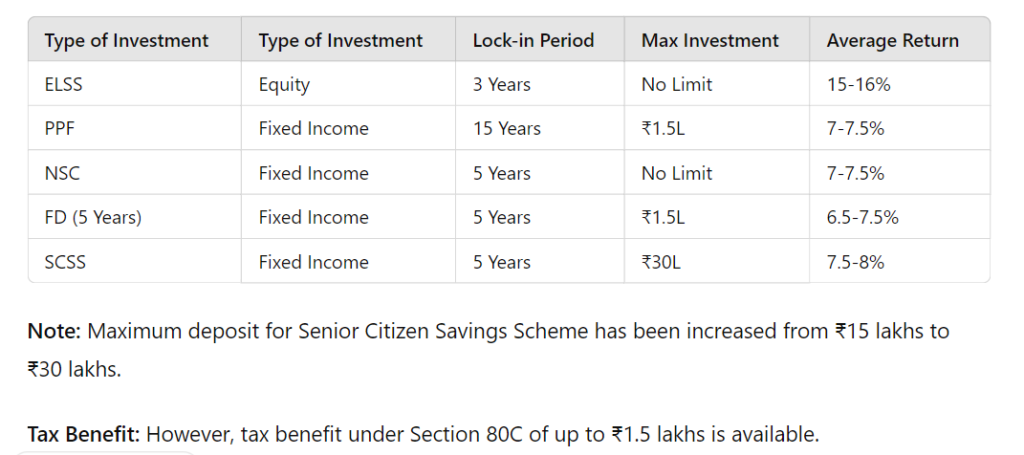

Investing in various schemes can help reduce your taxable income under Section 80C of the Income Tax Act of 1961. Here are some popular investment options:

- Equity-Linked Savings Scheme (ELSS)

- Type of Investment: Equity

- Lock-in Period: 3 Years

- Max Investment: No Limit

- Average Return: 15-16%

- Overview: ELSS funds are diversified equity mutual funds that offer tax benefits. These schemes have the potential to provide higher returns compared to other tax-saving instruments due to their exposure to equity markets. The minimum lock-in period is three years, which is the shortest among all Section 80C options.

- Public Provident Fund (PPF)

- Type of Investment: Fixed Income

- Lock-in Period: 15 Years

- Max Investment: ₹1.5 Lakhs per financial year

- Average Return: 7-7.5%

- Overview: PPF is a long-term savings scheme backed by the government of India, offering attractive interest rates and tax benefits. It is a safe investment option with a lock-in period of 15 years, and the interest earned is tax-free.

- National Savings Certificate (NSC)

- Type of Investment: Fixed Income

- Lock-in Period: 5 Years

- Max Investment: No Limit

- Average Return: 7-7.5%

- Overview: NSC is a fixed-income investment scheme that you can open at any post office in India. It is a safe and low-risk investment option suitable for individuals looking for a fixed return. The interest is compounded annually but is payable at maturity.

- Fixed Deposit (FD) – 5 Years

- Type of Investment: Fixed Income

- Lock-in Period: 5 Years

- Max Investment: ₹1.5 Lakhs

- Average Return: 6.5-7.5%

- Overview: Tax-saving fixed deposits have a lock-in period of five years. They offer guaranteed returns and are a safe investment option for risk-averse investors. The interest earned on these FDs is taxable.

- Senior Citizen Savings Scheme (SCSS)

- Type of Investment: Fixed Income

- Lock-in Period: 5 Years

- Max Investment: ₹30 Lakhs

- Average Return: 7.5-8%

- Overview: SCSS is a government-backed savings instrument for senior citizens aged 60 years and above. The scheme offers a higher interest rate compared to other fixed-income instruments. The lock-in period is five years, and the scheme can be extended for another three years upon maturity. The interest earned is taxable.

Tax Benefits

Investments in these schemes qualify for a deduction of up to ₹1.5 lakhs under Section 80C of the Income Tax Act. This means if your total taxable income is ₹ 10 lakhs and you invest ₹ 1.5 lakhs in these schemes, your taxable income will be reduced to ₹ 8.5 lakhs. This deduction helps reduce your tax liability, potentially saving you a significant amount in taxes. Each scheme has its unique benefits, risk profile, and returns, catering to different investment needs and risk appetites.

By investing in a mix of these instruments, you can achieve a balanced portfolio that not only provides tax savings and assured returns but also offers the potential for higher growth. This strategic approach to your investments can help you feel more in control of your financial future.