India’s GST Revenue Jumps 9.1% in February 2025 – Here’s What It Means

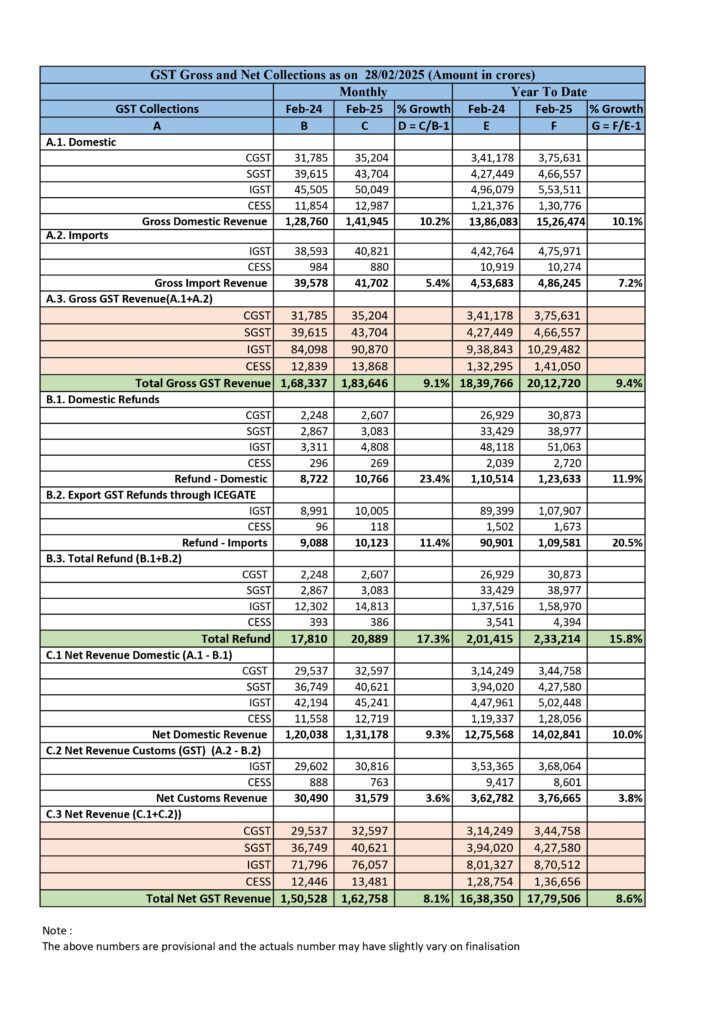

India’s Goods and Services Tax (GST) collection surged 9.1% YoY in February 2025, reaching ₹1.84 lakh crore. This growth was fueled by a 10.2% increase in domestic GST Collection February 2025 revenues, reflecting robust economic activity and improved compliance measures.

Breakdown of February 2025 GST Revenue

| GST Component | Feb 2024 (₹ Crore) | Feb 2025 (₹ Crore) | Growth (%) |

|---|---|---|---|

| Central GST (CGST) | 31,785 | 35,204 | 10.8% |

| State GST (SGST) | 39,615 | 43,704 | 10.3% |

| Integrated GST (IGST) | 84,098 | 90,870 | 8.1% |

| Compensation Cess | 12,839 | 13,868 | 8.0% |

| Total Gross GST Revenue | 1,68,337 | 1,83,646 | 9.1% |

Key Growth Drivers

✔️ Domestic GST revenue surged 10.2% to ₹1.42 lakh crore, reflecting higher economic activity.

✔️ GST on imports rose 5.4% to ₹41,702 crore, indicating steady trade flow.

✔️ Total refunds issued increased by 17.3%, reaching ₹20,889 crore.

✔️ Net GST revenue grew 8.1% to ₹1.63 lakh crore, up from ₹1.50 lakh crore in February 2024.

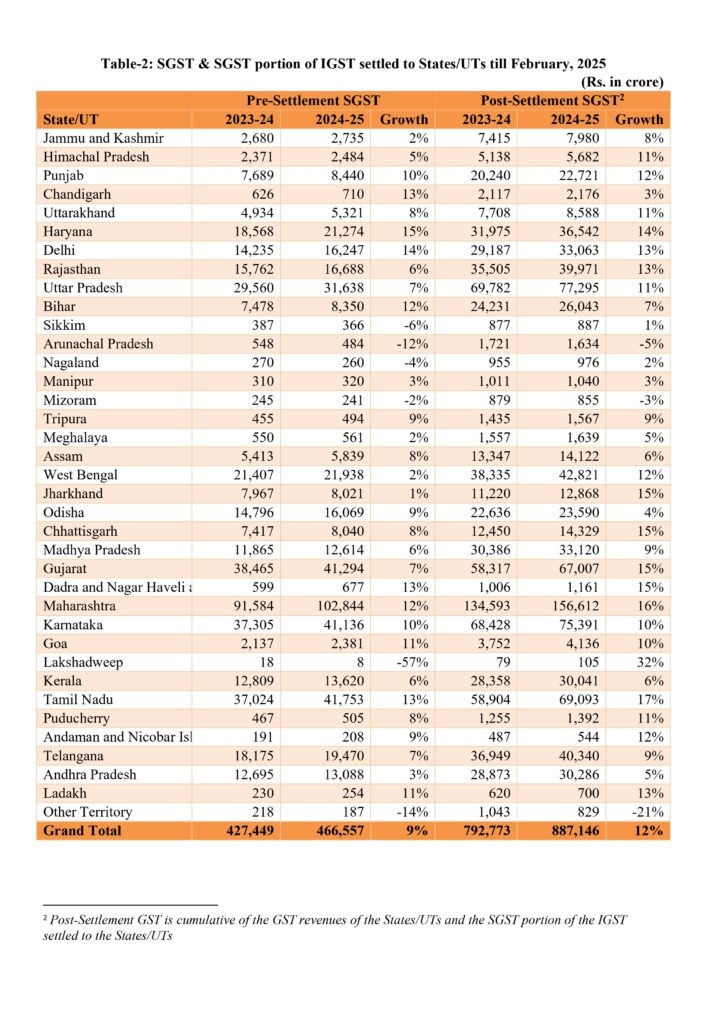

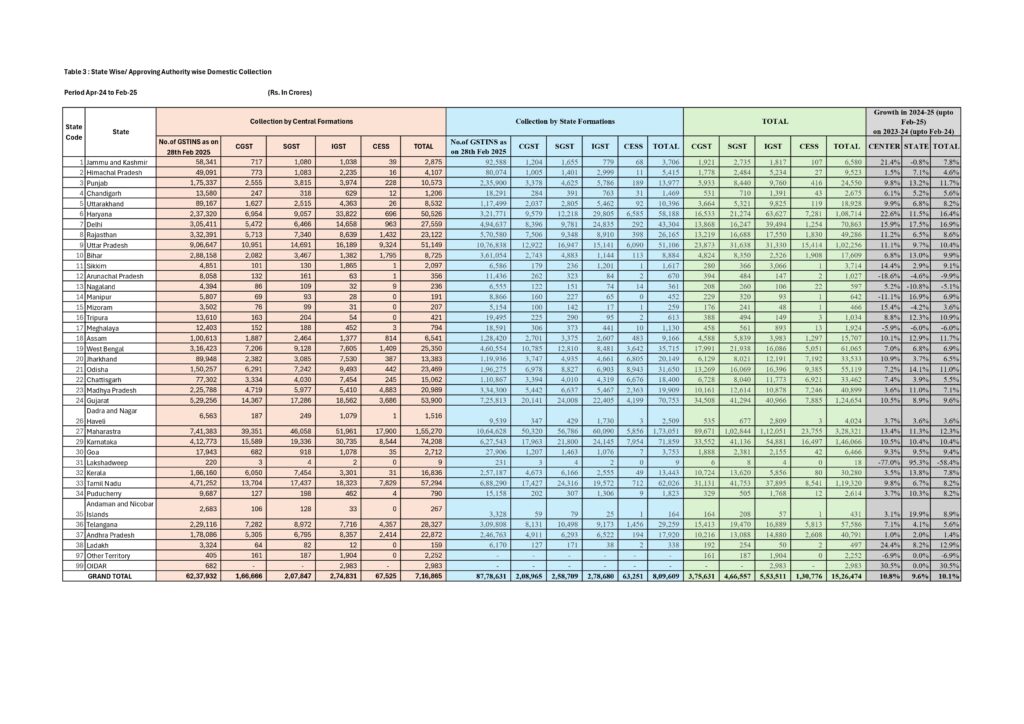

State-Wise GST Collection Performance

Some states saw double-digit GST growth, while others experienced declines:

| State/UT | Feb 2024 (₹ Cr) | Feb 2025 (₹ Cr) | Growth (%) |

| Haryana | 8,269 | 9,925 | 20% |

| Madhya Pradesh | 3,572 | 4,090 | 15% |

| Rajasthan | 4,211 | 4,787 | 14% |

| Maharashtra | 27,065 | 30,637 | 13% |

| West Bengal | 5,357 | 5,797 | 8% |

| Grand Total | 1,28,760 | 1,41,945 | 10% |

🔹 Highest Growth: Tripura (21%), Haryana (20%), Andaman & Nicobar Islands (32%). 🔹 Declining States: Lakshadweep (-55%), Ladakh (-46%), Mizoram (-16%).