India’s high-income taxpayers are on the rise, with a remarkable increase in the number of individuals reporting taxable incomes exceeding ₹1 crore. As of October 2023, over 220,000 people fall into this high-income category, with more than 100,000 joining in the last three years alone. This surge reflects significant shifts in the country’s economic landscape and has far-reaching implications.

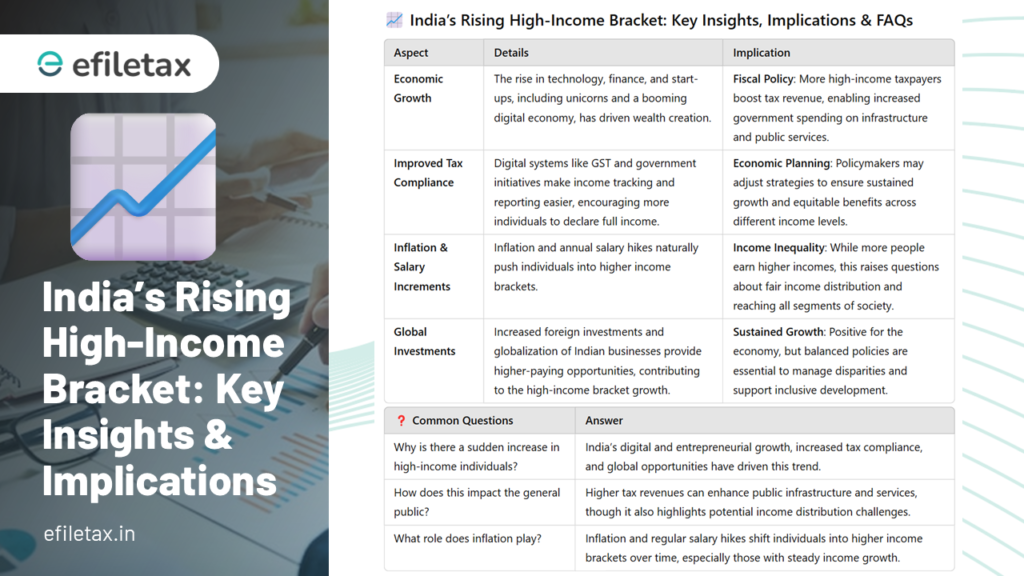

Factors Driving the Rise

Economic Expansion

- Technological Growth: The boom in technology sectors and the rise of startups turning into unicorns have created substantial wealth.

- Entrepreneurship: A supportive ecosystem for entrepreneurs has led to increased innovation and higher income potentials.

- Digital Economy: The proliferation of digital services has opened new revenue streams and employment opportunities.

Improved Tax Compliance

- Digitization of Tax Systems: Implementation of the Goods and Services Tax (GST) and advanced e-filing systems have streamlined tax reporting.

- Government Initiatives: Policies aimed at curbing black money and promoting transparency have encouraged full income disclosure.

Inflation and Salary Increments

- Cost of Living Adjustments: Regular salary hikes to match inflation rates naturally push incomes higher.

- Professional Growth: Career advancements and skill enhancements lead to higher-paying positions.

Global Investments

- Foreign Direct Investment (FDI): Increased FDI has boosted various sectors, offering lucrative job opportunities.

- Globalization: Indian companies expanding globally have access to international markets and revenues.

Implications India’s High-Income Taxpayers

Fiscal Policy

An increase in high-income taxpayers boosts government revenues through higher tax collections. This additional capital can be allocated to infrastructure projects, social welfare programs, and public services, potentially accelerating national development.

Income Inequality

While the rise in wealthy individuals is a positive economic indicator, it also highlights the widening gap between the rich and those with lower incomes. Addressing income inequality becomes crucial to ensure that economic growth is inclusive.

Economic Planning

Policymakers may need to revisit strategies to sustain economic growth while promoting equitable wealth distribution. This could involve tax reforms, investment in education, and support for small and medium-sized enterprises.

Relevant Case Laws

- Commissioner of Income Tax vs. B.C. Srinivasa Setty (1981): This case established principles on capital gains and asset transfers, affecting how high-income individuals manage wealth.

- Vodafone International Holdings B.V. vs. Union of India (2012): A landmark case influencing foreign investments and taxation, impacting global business operations in India.

- McDowell & Co. Ltd. vs. Commercial Tax Officer (1985): Addressed tax avoidance practices, reinforcing the need for compliance among high earners.

Common Questions India’s High-Income Taxpayers

Why has there been a sudden increase in high-income individuals?

The surge is due to economic growth in technology and entrepreneurship, better tax compliance, global investment opportunities, and natural income progression through inflation and salary hikes.

How does this affect the general population?

Higher tax revenues can lead to improved public services and infrastructure. However, it may also accentuate income inequality if not managed through inclusive policies.

What role does inflation play in this trend?

Inflation contributes by increasing the nominal income required to maintain the same purchasing power, pushing more individuals into higher tax brackets over time.

Useful Resources

Income Tax Department of India Official guidelines and resources for taxpayers.

Tax filing help reach us efiletax