Filing your income tax returns can be overwhelming. However, if you’ve incurred a business loss, understanding your carry forward rights can significantly ease your tax burden. If you’re into F&O (Futures and Options) trading or run any kind of business, understanding how long such losses can be carried forward is essential for effective tax planning. This blog explains the key provisions of the Income Tax Act related to carrying forward business losses, especially those from F&O trades.

What Is a Business Loss?

A business loss refers to a negative income figure under the head “Profits and Gains of Business or Profession”, where expenses exceed income. These may arise from:

- F&O trading

- Proprietorship or partnership businesses

- Freelancing or consultancy

- Manufacturing or trading operations

Are F&O Losses Treated as Business Losses?

Yes. As per Section 43(5) of the Income Tax Act:

- The Income Tax Act does not treat F&O transactions on recognised stock exchanges as speculative.

- Therefore, losses from F&O trading are classified as ordinary (non-speculative) business losses.

How Long Can You Carry Forward Business Losses?

According to Section 72:

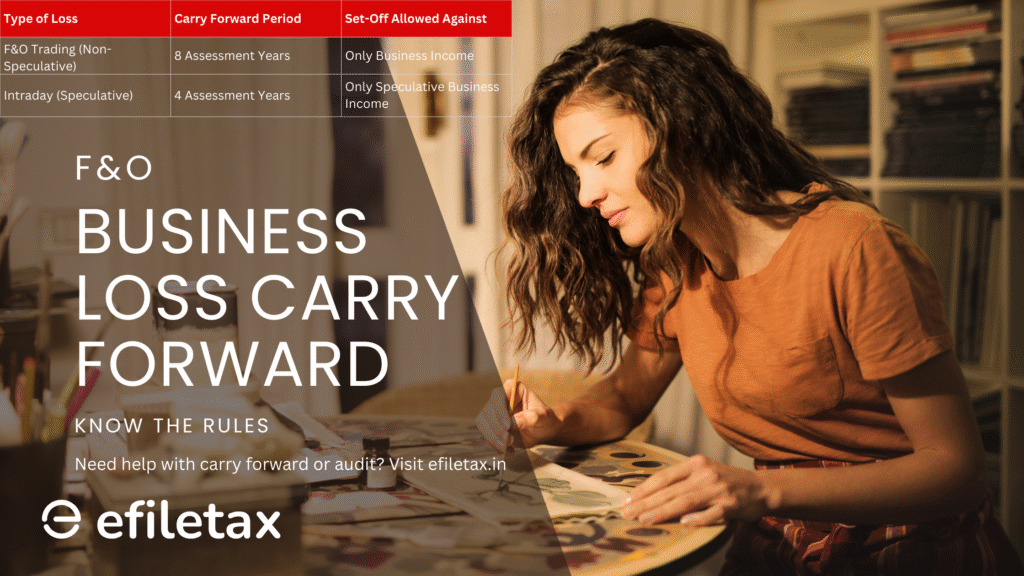

| Type of Loss | Carry Forward Period | Set-Off Allowed Against |

|---|---|---|

| Non-speculative (F&O) | 8 Assessment Years | Only against business income |

| Speculative (e.g. intraday equity) | 4 Assessment Years | Only against speculative income |

Conditions for Carry Forward

- Return must be filed on time under Section 139(1).

- If turnover exceeds ₹1 crore (or ₹10 crore if no cash transactions), a tax audit under Section 44AB is mandatory.

- Set-Off Rules:

- In the current year: Can be set off against other business income (not salary).

- In future years: Can only be set off against business income.

Example: Carry Forward Timeline

Let’s assume:

- Assessment Year (AY): 2025–26

- Business Loss Declared: ₹15,24,970

- Filed on time: Yes

- Nature: F&O trading (non-speculative)

➡️ This loss can be carried forward up to AY 2033–34 (8 assessment years).

Best Practices for Traders & Business Owners

- ✅ File returns before the due date, even if there’s no income.

- ✅ Maintain records of all expenses, trades, and books of account.

- ✅ Get your accounts audited if turnover conditions apply.

- ✅ Consult a tax expert for accurate classification and reporting.

Understanding the carry forward rules for business and F&O losses can help you lower your future tax liability. With correct classification, timely filing, and proper documentation, you can fully utilise the 8-year benefit under Indian tax laws.

Stay compliant. Save tax. Plan smart with EfileTax.