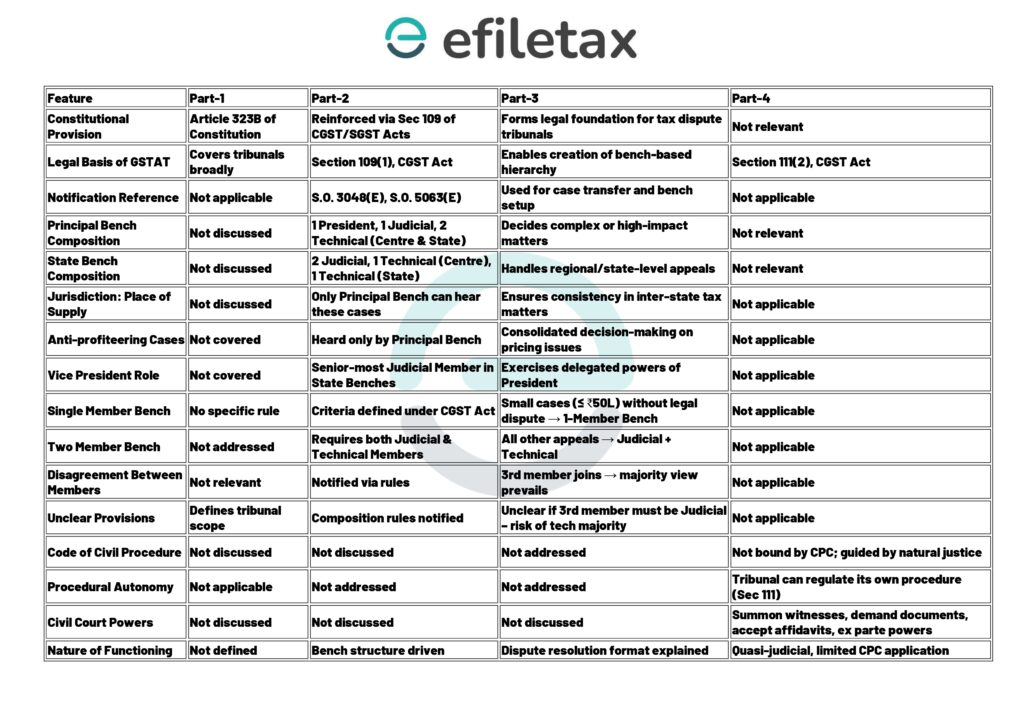

The Wait for GSTAT Nears Its End

The Goods and Services Tax Appellate Tribunal (GSTAT) is finally on track to become operational after nearly eight years of GST implementation. Meant to reduce litigation load on High Courts, GSTAT will provide faster resolution of GST disputes with subject-matter expertise.

📜 Constitutional Backing for GST Tribunals

The constitutional foundation for GSTAT lies in Articles 323A and 323B introduced via the 42nd Constitutional Amendment (1976).

Key Points from Article 323B

- Allows Parliament and State Legislatures to form tribunals for matters including taxation.

- Covers levy, assessment, collection, and enforcement of tax.

- Permits exclusion of jurisdiction of regular courts (except Supreme Court under Article 136).

🧾 Legal Angle: The GST Tribunal thus has a strong constitutional foundation under Article 323B(2).

GSTAT Structure Principal & State Benches

Legal Provision

Section 109(1) of the CGST Act, 2017 empowers the central government to notify the formation of GSTAT.

Key Notifications

- S.O. 3048(E) dated 31.07.2024

- S.O. 5063(E) dated 26.11.2024 (amendment)

Bench Composition

| Bench Type | Location | Composition |

|---|---|---|

| Principal Bench | New Delhi | President, 1 Judicial Member, 1 Technical (Centre), 1 Technical (State) |

| State Bench | State-specific | 2 Judicial Members, 1 Technical (Centre), 1 Technical (State) |

Each State Bench will have a Vice-President (senior-most Judicial Member).

Appeals Before GSTAT Who Hears What?

| Nature of Matter | Bench Type |

|---|---|

| Appeals with Place of Supply issue | Principal Bench |

| Anti-profiteering disputes (Sec 171(2)) | Principal Bench |

| Other standard appeals | Principal/State Bench (based on location) |

Govt may notify more categories to be exclusively heard by Principal Bench.

Bench Distribution & Hearing Mechanism

Case Distribution

The President of GSTAT can transfer cases across benches via general/special orders.

Single Member Bench

Permitted if:

- Tax/ITC/Fine involved is ≤ ₹50 lakhs, and

- No question of law involved

- Requires President’s approval

Note: There’s ambiguity on whether matters concerning interest determination alone qualify for single-member hearing.

Dual Member Bench

Mandatory for all other cases – includes one Judicial Member and one Technical Member.

What If Members Disagree?

Process for Difference of Opinion

| Situation | Third Member Source | Final Decision Basis |

|---|---|---|

| State Bench | Another State Bench (same or different state) | Majority opinion including original two members |

| Principal Bench | Another Principal or State Bench member | Majority as above |

Legal Grey Area: Statute is silent on whether the third member must be Judicial or Technical, raising concerns on balance of decision-making.

Civil Procedure Code: Limited Role in GSTAT

Section 111(1) – Autonomy of Procedure

GSTAT is not bound by CPC and will follow principles of natural justice.

Section 111(2) – CPC Powers Available

Tribunal can act like a civil court only for specific matters:

- Summoning and examining witnesses

- Document production

- Evidence on affidavit

- Requisitioning public records

- Issuing commissions

- Ex parte orders and dismissals

- Any other prescribed matters

How GSTAT Can Transform Litigation

“With Principal and State Benches operational soon, GSTAT will significantly reduce High Court burden. But procedural clarity—especially on third member appointment and single-bench hearings—is still awaited.”

🔄 Summary: GSTAT Highlights in One Glance

| Feature | Details |

|---|---|

| Constitutional Backing | Articles 323A & 323B |

| CGST Sections Involved | Sections 109 to 111 |

| Notification for Formation | S.O. 3048(E) & S.O. 5063(E) |

| Benches | Principal Bench (Delhi), State Benches (on request) |

| Bench Powers | Regulates own procedure; limited CPC powers under Sec 111(2) |

| Appeal Distribution | Based on value, question of law, and type of issue (e.g. place of supply) |

| Final Hearing Method | Majority opinion among differing members |

FAQ GSTAT Implementation

Q1. Is GSTAT functioning now?

It is being operationalized. Notifications for benches have been issued.

Q2. Can all appeals be filed before State Benches?

No. Place of supply or anti-profiteering matters go to Principal Bench.

Q3. Is GSTAT faster than courts?

Yes. It’s designed for quicker, expert-led adjudication.

Stay GST-Ready with Efiletax

GSTAT is a major step toward tax justice—but its complexity calls for expert assistance.

Need help with GST appeals or compliance?