GST Registration Grievances Addressed

The focus keyphrase GST registration grievance redressal takes center stage in Bengaluru Zone with the issuance of Public Notice No. 01/2025 dated 9 May 2025. This aims to resolve issues faced by applicants during new GST registration—especially around document clarifications and officer queries.

Why This Redressal Mechanism Was Needed

Many GST applicants were being asked for documents:

- Not mentioned in Form GST REG-01

- Or beyond the standard list prescribed by law

Common friction points included:

- Ownership proof for principal place of business

- Unregistered rent agreements

- Identity proof for consent-based premises

- Additional business constitution documents

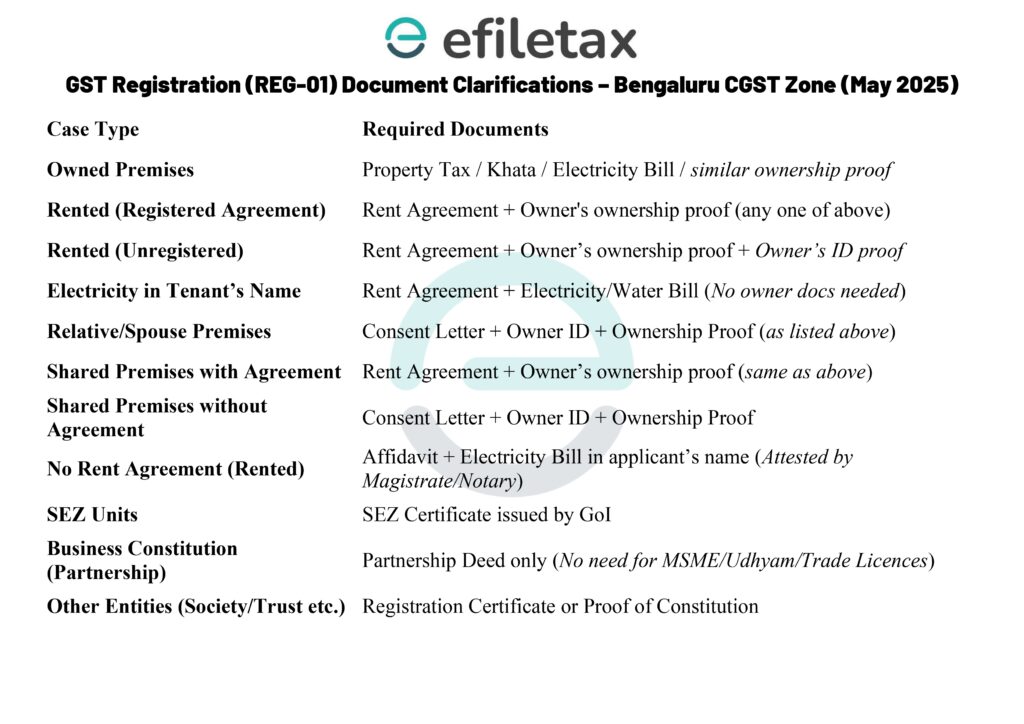

🧾 Updated Guidelines for GST Registration Documents

📍 1. Principal Place of Business (PPOB)

| Type of Premises | Required Documents |

|---|---|

| Owned | Any one: Property Tax receipt / Municipal Khata / Electricity or Water Bill |

| Rented (Registered Lease) | Rent/Lease Agreement + any one of the above owner documents |

| Rented (Unregistered Lease) | Above + identity proof of lessor |

| Tenant name on utility | Rent Agreement + Bill in applicant’s name – no need for owner’s proof |

| Premises owned by relative/spouse | Consent letter + ID proof of owner + one ownership proof document |

| Shared premises | Same rules as above depending on lease status |

| No Rent Agreement | Affidavit + applicant’s name in electricity bill; executed before Magistrate/Notary |

| SEZ Premises | Govt-issued SEZ developer certificate |

📍 2. Constitution of Business

| Applicant Type | Required Document |

|---|---|

| Partnership Firms | Partnership Deed only |

| Society, Trust, AOP, etc. | Registration Certificate/Proof of Constitution |

| No need to upload | Udyam, MSME, Trade License, Shop Act, etc. |

📩 How to Raise a GST Registration Grievance in Karnataka

If your Application Reference Number (ARN) falls under Central jurisdiction and you face issues contrary to this circular:

🔁 Two Ways to Register Your Complaint:

🖥️ Email Grievance Submission

Send to: cgst-blr@gov.in

Include:

- Name of entity

- ARN and ARN Date

- Jurisdiction (Centre/State)

- Brief issue

🏢 Walk-in Support

Visit the GST Seva Kendra, 3rd Floor, C.R. Building Annex, Queens Road, Bengaluru – 560001

Phone: 080-22866812

✅ All complaints will be resolved promptly, and the applicant will be intimated directly.

🔍Simplification & Accountability

This redressal framework ensures:

- No arbitrary document demands by officers

- Recognition of utility bills in tenant’s name

- Acceptance of consent letters + minimal documentation

- Clear process to contest unjust queries or rejections

Always check whether your ARN is under Central or State jurisdiction before escalating grievances.

GST Registration Grievance Redressal

| Feature | Details |

|---|---|

| Circular Issued By | Principal Chief Commissioner, CGST Bengaluru Zone |

| Circular Date | 9 May 2025 (Public Notice 01/2025) |

| Key Focus | Reducing unjust document demands during GST registration |

| Email Support | cgst-blr@gov.in |

| Physical Support | GST Seva Kendra, Queens Road, Bengaluru |

| Who Can Apply | Applicants under Central Jurisdiction – Karnataka |

🙋 FAQ on GST Registration Redressal

Q1. Can I raise a grievance if I’m under State jurisdiction?

No. This mechanism is currently limited to Central jurisdiction in Karnataka.

Q2. My rent agreement is unregistered. Can I still register for GST?

Yes. Upload agreement + owner’s utility bill + their ID proof.

Q3. Do I need Udyam/MSME certificate for partnership firms?

No. Only Partnership Deed is mandatory.

Don’t Let Registration Delays Affect Your Business

Whether you’re a startup or established trader, GST registration delays can cost you clients, contracts, and compliance penalties.

Bengaluru CGST Zone launches GST registration grievance redressal system via Public Notice 01/2025. Applicants can now report document-related issues, unnecessary rejections, and non-standard queries. Clear rules issued for ownership proof, rent agreements, consent letters, and business constitution documents.

🛠️ Need end-to-end help with GST registration or resolving officer queries?

👉 Contact Efiletax GST Experts Today →