GST on Sarees & Salwar Suits in India (2025): 5% or 18%? Don’t Make This Costly Mistake

If you sell sarees or salwar suits in India, one small GST classification error can wipe out your margin.

Most boutique owners, online sellers, and even accountants confuse one simple rule:

Unstitched = Fabric

Stitched = Garment

And that single difference decides whether you pay 5% or 18% GST.

Let’s break this down clearly.

The Big Question: Is It Stitched?

Under GST, the tax rate on sarees and salwar suits does not depend only on price. It depends first on structure.

If the product is unstitched fabric → It is taxed as fabric.

If it is stitched and wearable → It becomes apparel.

This shift changes both HSN code and GST rate.

GST on Unstitched Sarees (Fabric Category)

Traditional sarees sold as drape fabric are treated as textile fabric, not garments.

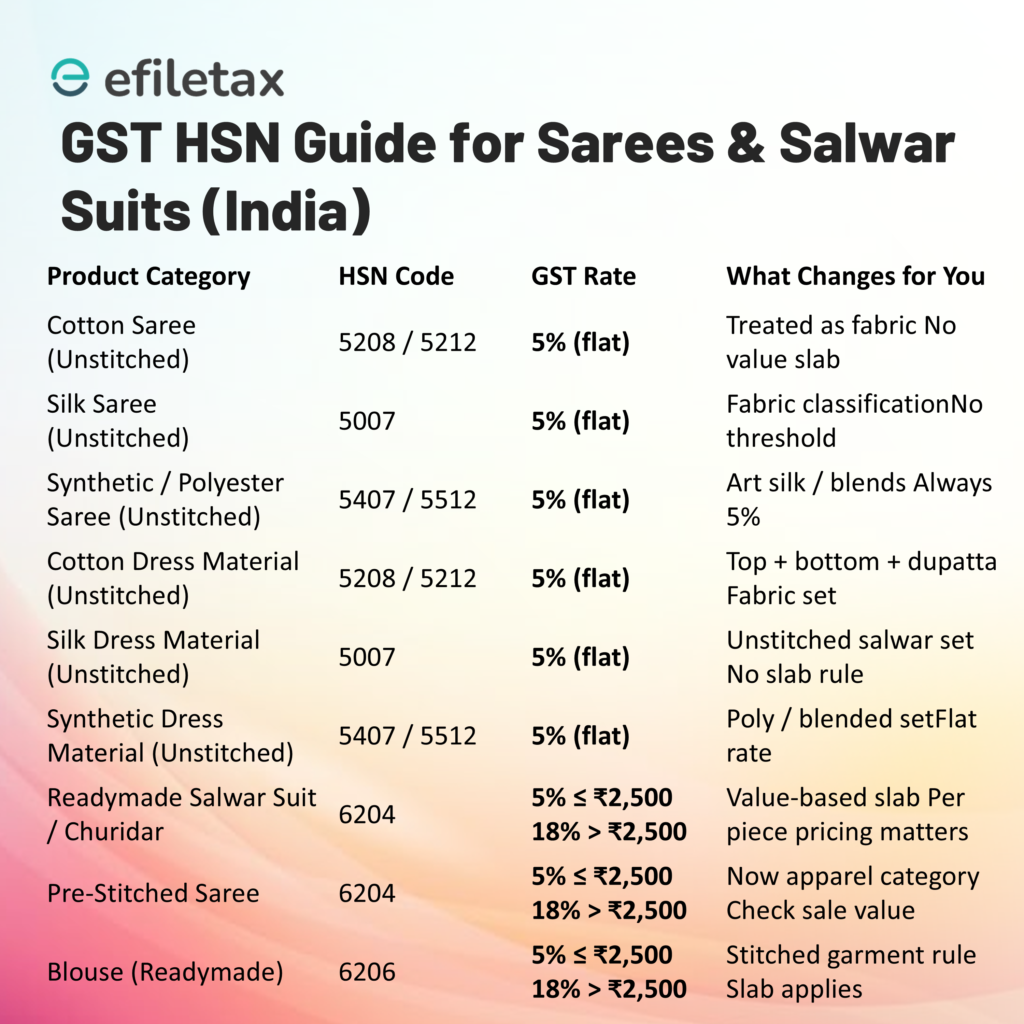

HSN Codes Based on Material:

Cotton saree → 5208 / 5212

Silk saree → 5007

Polyester saree → 5407

Synthetic / blended saree → 5512

GST Rate:

5% flat rate

There is no ₹2,500 limit for unstitched sarees.

Even if a silk saree is sold for ₹25,000, GST remains 5% because it is classified as fabric.

Common Mistake:

Many sellers wrongly assume expensive sarees attract 18%. That slab does not apply to unstitched sarees.

GST on Unstitched Dress Material (Salwar Sets)

If you sell:

Top fabric

Bottom fabric

Dupatta fabric

And none of it is stitched, it is still fabric.

HSN Codes:

Cotton dress material → 5208 / 5212

Silk dress material → 5007

Synthetic dress material → 5407 / 5512

GST Rate:

5% flat, no value limit.

Important:

Even if sold as a complete set, it is not treated as apparel unless stitched.

When GST Jumps to 18%: Stitched Products

The moment the product is stitched and wearable, GST rules change.

It now falls under ready-made garments.

HSN Codes:

Readymade salwar suit → 6204

Readymade churidar → 6204

Pre-stitched saree → 6204

Readymade blouse → 6206

GST Rate (Value-Based Slab):

5% if sale value per piece ≤ ₹2,500

18% if sale value per piece > ₹2,500

This ₹2,500 rule applies per piece, not per invoice.

Example:

One stitched suit sold at ₹2,600 → 18% GST

Two stitched suits sold at ₹2,400 each → 5% GST per piece

This is where many brands make billing errors.

Pre-Stitched Saree: The Most Misclassified Product

A normal saree (unstitched) → 5% flat

A pre-stitched saree (ready-to-wear) → treated as garment

HSN: 6204

GST: 5% or 18% depending on ₹2,500 threshold

This single difference has triggered GST notices for many boutique owners.

Why Correct HSN Code Matters

Wrong HSN or GST rate can result in:

Short payment of GST

Interest liability

Penalty

GST scrutiny or notice

ITC mismatch issues

For D2C brands and Instagram boutiques, this can become a serious compliance risk.

For Brands Like “Laced with Grace”

If you sell both:

Unstitched sarees → 5%

Stitched blouses → 5% / 18%

You must:

Apply GST separately per item

Use correct HSN code on invoice

Configure accounting software correctly

Check per-piece sale value

You cannot apply one flat rate across all products.

Quick Compliance Checklist Before Filing GSTR-1

Ask yourself:

Is this stitched or unstitched?

What is the correct HSN code?

Is the per-piece value above ₹2,500?

Have I applied correct GST slab?

Does invoice description clearly match product type?

This 5-minute check can prevent a costly GST notice.

Final Takeaway: One Stitch Can Change Your GST

In the textile business, GST does not depend only on fabric type or price.

It depends on:

Fabric vs Garment

HSN classification

₹2,500 per-piece value

If it is unstitched → 5% flat.

If it is stitched → check ₹2,500 slab.

Before you upload your next product or issue your next invoice, verify classification once.

Because under GST, one stitch can cost you 13% extra tax.