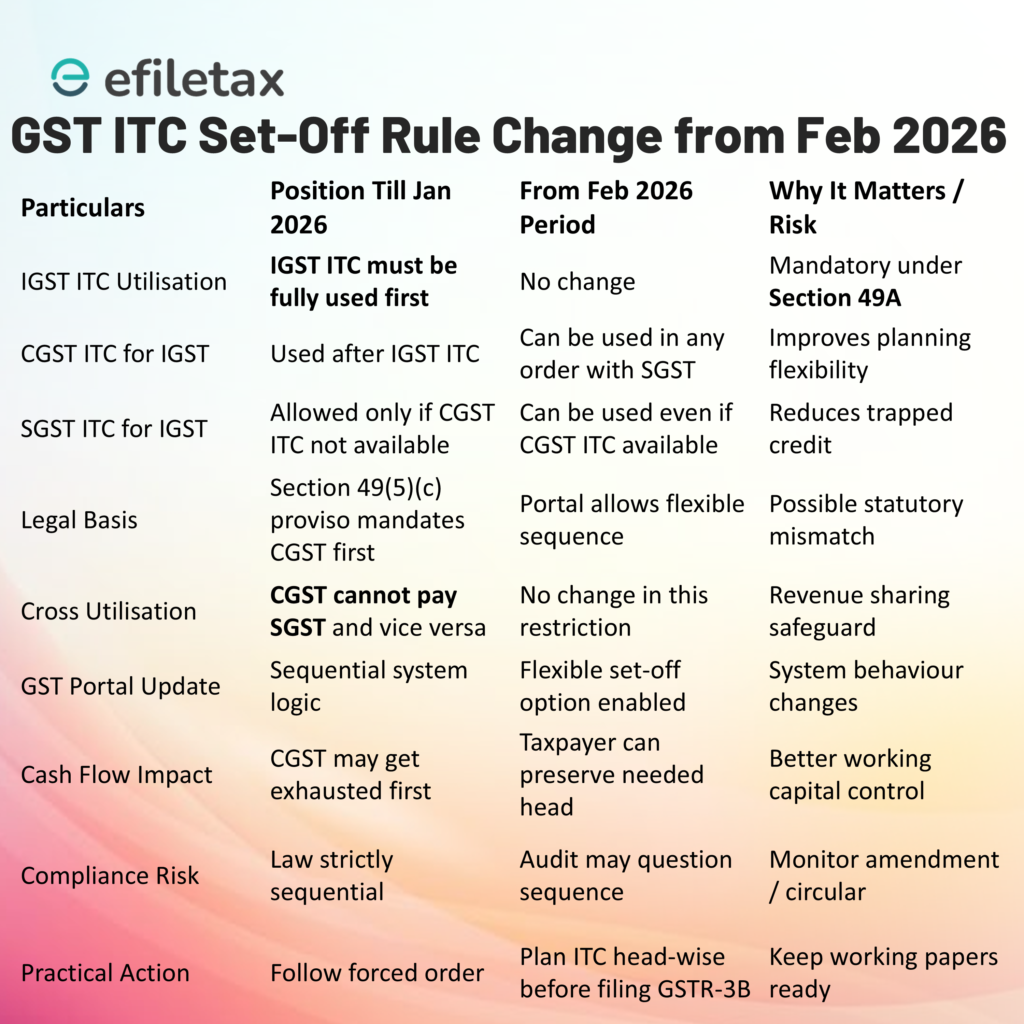

Now You Can Use CGST or SGST Credit in Any Order for IGST Payment

India’s GST system is slowly moving toward cash-flow friendly compliance.

From the February 2026 tax period, the GST portal allows taxpayers to utilise:

CGST or SGST Input Tax Credit (ITC) in any order for paying IGST liability — after exhausting IGST credit.

This looks like a small technical change.

But in reality — this is one of the most important working-capital reliefs introduced in recent years.

Let’s understand it clearly.

1. How ITC Set-off Worked Earlier

Under GST law, credit utilisation followed a strict hierarchy.

Old System (Till Jan-2026)

| Step | Credit Used | For Paying |

|---|---|---|

| 1 | IGST Credit | IGST first |

| 2 | CGST Credit | IGST next |

| 3 | SGST Credit | Only after CGST finished |

So even if you had large SGST credit, you could not use it until CGST credit became zero.

What Problem Did This Create?

Businesses often faced this situation:

| Credit Available | Liability | Result |

|---|---|---|

| High SGST Credit | IGST Payable | Credit stuck |

| Low CGST Credit | Future CGST liability | Cash payment needed |

| Overall Enough ITC | Still paid tax in cash | Working capital blocked |

This is called trapped credit problem.

2. New System (From Feb-2026)

After IGST credit becomes zero:

You can now choose whether to use CGST or SGST credit first.

New Set-off Logic

| Step | Credit Used | Rule |

|---|---|---|

| 1 | IGST | Mandatory first |

| 2 | CGST or SGST | Any order (taxpayer choice) |

3. Simple Practical Example

Situation

| Particular | Amount |

|---|---|

| IGST Liability | ₹10,00,000 |

| IGST Credit | ₹4,00,000 |

| CGST Credit | ₹1,00,000 |

| SGST Credit | ₹5,00,000 |

Old Rule Outcome

| Utilisation | Amount |

|---|---|

| IGST used | 4,00,000 |

| CGST forced used | 1,00,000 |

| SGST used | 5,00,000 |

Later when CGST liability arises → Cash payment required

New Rule Outcome (You Decide)

You can preserve CGST credit:

| Utilisation | Amount |

|---|---|

| IGST used | 4,00,000 |

| SGST used | 6,00,000 |

Now future CGST liability → No cash payment

4. Why Government Introduced This

The GST framework has different tax heads because revenue is shared between Centre and States.

But strict utilisation order created:

• artificial cash payments

• blocked working capital

• compliance frustration

• unnecessary interest burden

The update improves liquidity without reducing tax collection.

Government gets tax — but businesses don’t suffer cash crunch.

5. Legal Confusion Professionals Must Know

Here is the important technical part.

Law (Section 49(5))

Still mentions sequence:

IGST → CGST → SGST

Portal (Feb-2026 update)

Allows:

IGST → (CGST OR SGST any order)

So currently:

| Aspect | Position |

|---|---|

| Portal behaviour | Flexible |

| Statute wording | Sequential |

| Risk level | Low but monitor updates |

Meaning:

The system allows flexibility — but law wording may be updated later.

6. Should Taxpayers Use It?

Yes — but correctly.

Safe Practice

- Always exhaust IGST first

- Choose utilisation logically (cash-flow planning)

- Keep monthly working papers

- Follow portal auto-setoff only (do not manually override logic)

7. What Changes for Businesses

Before

Working capital planning based on GST restrictions

Now

Working capital planning based on business need

This especially helps:

• traders doing interstate sales

• ecommerce sellers

• manufacturers with branch transfers

• multi-state service providers

8. What Professionals Must Start Advising

Earlier advice:

Follow portal set-off

New advice:

Optimise credit utilisation

GST compliance now includes tax planning element, not just filing.

Final Takeaway

This change does not reduce tax liability.

It removes unnecessary cash blockage.

GST is moving from a “collection system” to a “settlement system”.

And this update is a strong step toward a mature credit-based tax framework.

Effective: February 2026 return (GSTR-3B)

Impact: Improves cash flow

Action: Start monthly ITC optimisation planning