GST Collections April 2025: Record-Breaking ₹2.37 Lakh Crore Signals Economic Strength

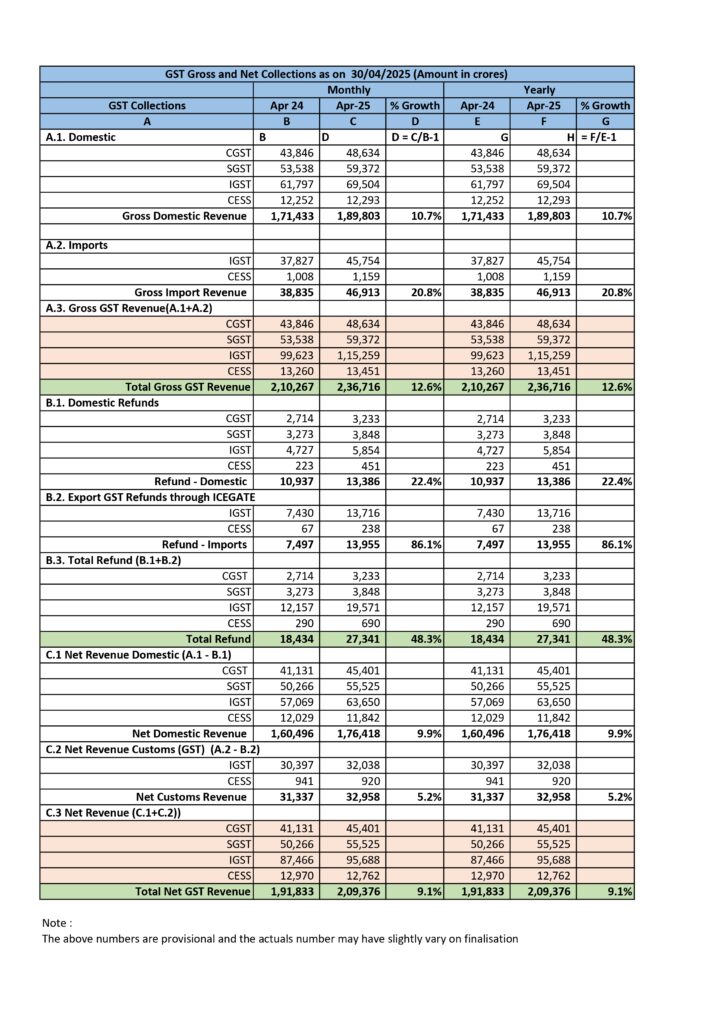

India’s GST collections in April 2025 have hit an all-time high of ₹2.37 lakh crore, according to official government data released on May 2, 2025. This figure marks a 12.6% year-on-year growth, setting a new benchmark since the launch of the GST regime in July 2017.

What’s behind the record GST collections?

Here’s a breakdown of how the numbers stack up:

| Category | Amount (₹ crore) | Growth (%) |

|---|---|---|

| Total Gross GST | 2,37,000 | 12.6% YoY |

| GST from Domestic Transactions | ~1,90,000 | 10.7% YoY |

| GST on Imported Goods | 46,913 | 20.8% YoY |

| Refunds Issued | 27,341 | 48.3% YoY |

| Net GST after Refunds | 2,09,659 | 9.1% YoY |

Source: Ministry of Finance, Press Release, May 2025

Why are GST collections so high in April?

1. Year-End Reconciliations

April often sees additional tax payments as businesses finalize and reconcile their books for the financial year.

2. Stronger Compliance Framework

E-invoicing, AI-based scrutiny, and improved GSTN infrastructure have streamlined compliance.

3. Export Growth Before Tariffs

April saw a surge in exports to the US, as Indian exporters rushed shipments before the imposition of new reciprocal tariffs.

4. Refund Automation

Quick processing of ₹27,341 crore worth of refunds in April reflects CBIC’s push for faster turnaround—easing working capital strain for exporters.

Expert Insights: What the High GST Collections Mean

🔹 “These numbers indicate robust economic activity and improved compliance,” says Abhishek Jain, Indirect Tax Head, KPMG India.

🔹 EY India’s Saurabh Agarwal adds, “This reflects not only a rebound but also proactive government policy on refunds and manufacturing growth.”

Budget 2025 Target: Are We on Track?

The Union Budget estimates a total GST revenue of ₹11.78 lakh crore for FY 2025–26 (including compensation cess and CGST). If the monthly average stays above ₹1.90 lakh crore, the target is well within reach.

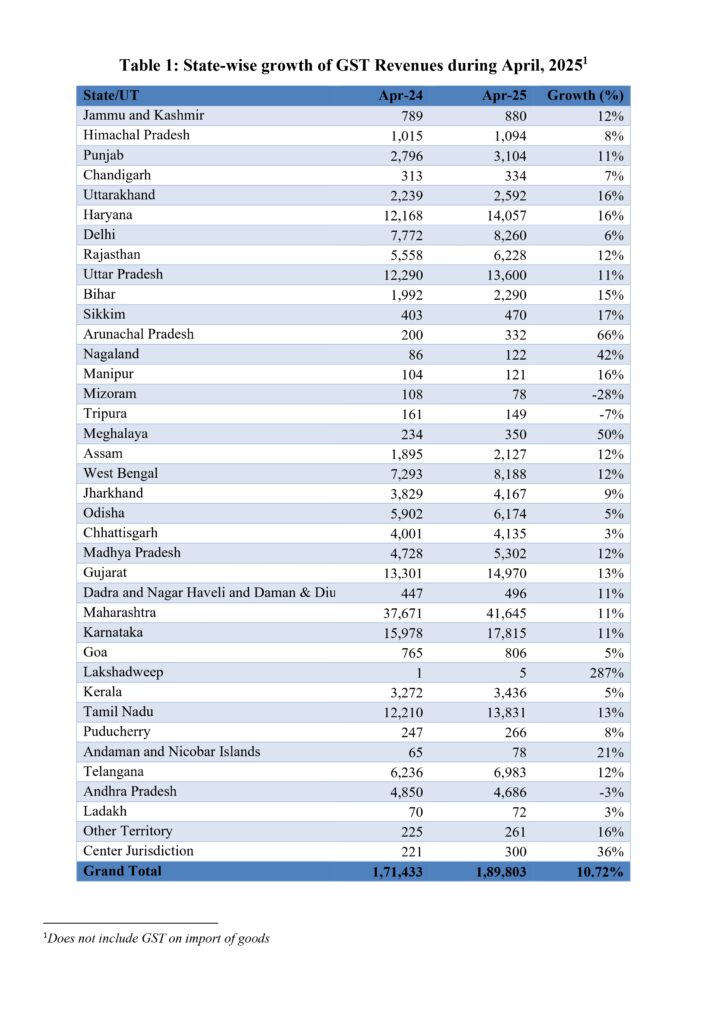

State-Wise Growth: Even the Smallest States Shine

Significant YoY growth in remote regions indicates the depth of GST penetration:

- Meghalaya, Nagaland, Arunachal Pradesh – High growth rates

- Andaman & Nicobar, Lakshadweep – Tax collection from tourism and trade jumps

- Manufacturing Hubs – Tamil Nadu, Maharashtra, Gujarat lead in domestic GST

Legal References and Official Sources

- 📄 GST Revenue Report – April 2025, PIB

- 🏛️ GST Laws: CGST Act, 2017 and recent Budget 2025 provisions

- 🔍 CBIC Circulars on Refund Automation and Compliance Drive

Practical Tip from Efiletax

Reconcile your books early each quarter.

Delayed reconciliations not only risk errors but also defer input tax credit claims, affecting your working capital.

Final Word

The record-breaking GST collections in April 2025 are more than just numbers—they’re a signal of economic resilience, improved compliance, and streamlined refund systems. While next month may moderate due to global factors, the momentum for FY 2025–26 appears strong.

Need help with your GST filings or refunds?

👉 Visit Efiletax.in for expert-assisted GST return filing, reconciliation, and compliance tracking.

FAQ: GST Collections April 2025

Q1. What is the highest-ever GST collection in India?

A. April 2025 recorded ₹2.37 lakh crore—the highest since GST began in 2017.

Q2. What led to this spike in GST revenue?

A. Year-end reconciliations, high exports, compliance improvements, and automated refunds.

Q3. Is the GST revenue target for FY 2025–26 achievable?

A. Yes, if monthly collections stay above ₹1.90 lakh crore, the ₹11.78 lakh crore target is realistic.