Introduction

The Government of India has introduced a new GST Amnesty Scheme under Section 128A of the Central Goods and Services Tax (CGST) Act, 2017. Starting from November 1, 2024, this scheme provides relief to taxpayers by waiving interest and penalties related to GST demands from the financial years 2017-18 to 2019-20. This initiative is aimed at helping businesses struggling with compliance settle their tax obligations without extra financial burdens.

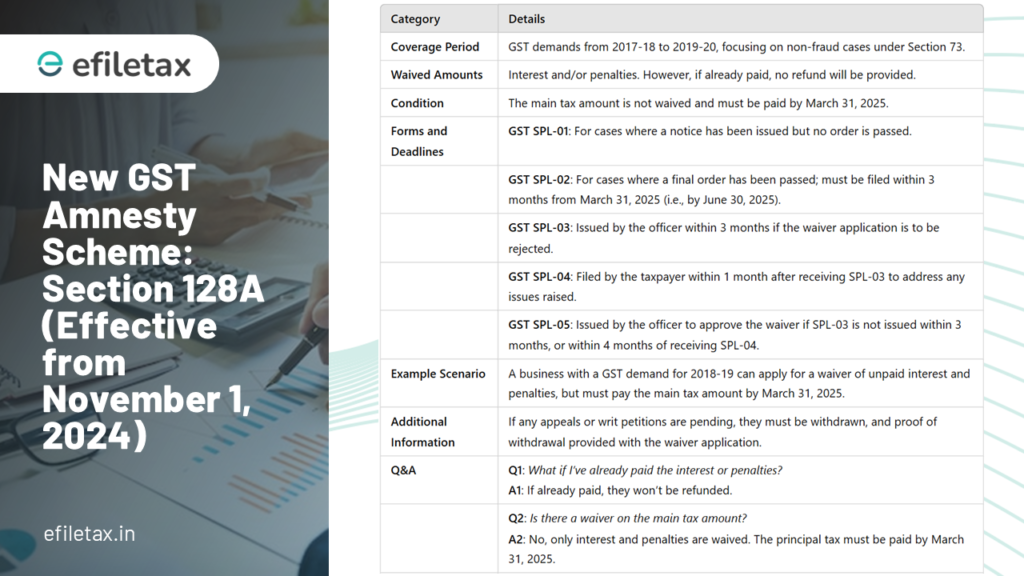

Key Features of the GST Amnesty Scheme

The GST Amnesty Scheme assists taxpayers with outstanding GST demands by offering a waiver of penalties and interest. Here are the key features and details of the scheme:

- Effective Date: The scheme applies from November 1, 2024, and covers GST demands from 2017-18 to 2019-20.

- Scope of Waiver: The scheme waives interest and penalties for GST demands raised under Section 73 of the CGST Act, specifically for non-fraudulent cases. Interest or penalties already paid before the scheme will not be refunded.

- Conditions for Waiver: The scheme does not waive the tax amount itself. Taxpayers must pay the outstanding tax by March 31, 2025 to benefit from the waiver.

Forms and Procedures to Avail the Amnesty

The scheme includes a straightforward process to ensure compliance for taxpayers. The following forms are essential to avail of the waiver:

- Form GST SPL-01: To be filed electronically if a notice has been issued but no final order has been passed.

- Form GST SPL-02: Applicable when a final order has already been passed. Taxpayers need to file this form within three months from March 31, 2025, i.e., by June 30, 2025.

- Form GST SPL-03: Issued by the tax officer within three months of receiving the waiver application if the waiver request is rejected.

- Form GST SPL-04: If Form SPL-03 is issued, taxpayers must respond by filing Form SPL-04 within one month to address the issues raised.

- Form GST SPL-05: Issued by the officer approving the waiver within three months if SPL-03 is not issued. If SPL-03 is issued, the officer will provide SPL-05 within four months of receiving SPL-04.

Important Considerations

- The scheme does not waive the tax amount—only penalties and interest are waived.

- The waiver applies only to demands raised in non-fraudulent cases under Section 73 of the CGST Act.

- Taxpayers must follow the timelines to fully benefit from the scheme.

Benefits of the Amnesty Scheme

The new GST Amnesty Scheme provides significant relief to taxpayers by:

- Reducing Financial Burden: The waiver of interest and penalties eases the financial strain on taxpayers, helping them clear their GST liabilities more comfortably.

- Encouraging Compliance: By waiving penalties, the scheme motivates taxpayers to comply with their tax obligations and regularize past liabilities.

- Simplified Resolution of Issues: It offers a straightforward mechanism to resolve pending GST demands without the extra costs of penalties and interest.

Conclusion

The GST Amnesty Scheme 2024 is a proactive step by the government to reduce the compliance burden on taxpayers and help them clear their tax liabilities with fewer financial constraints. Taxpayers should take advantage of this limited-time opportunity to regularize their GST status and ensure compliance with tax regulations.