When handling payments, cheques remain a widely trusted tool. However, knowing the differences between Crossed vs Bearer Cheques can help you make better decisions. Here’s a clear breakdown of their features and uses:

Crossed Cheque vs Bearer Cheque

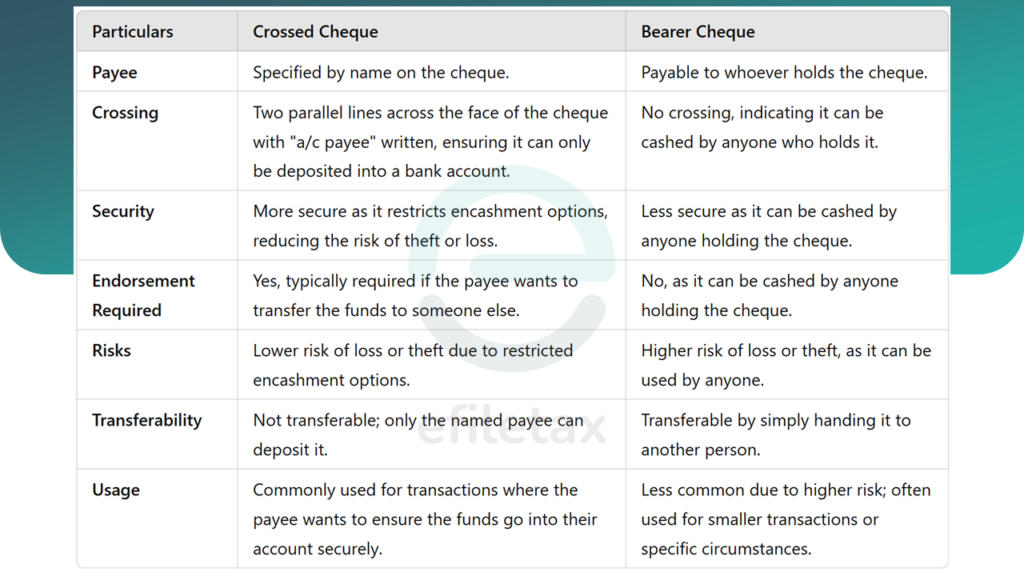

| Particulars | Crossed Cheque | Bearer Cheque |

|---|---|---|

| Payee | Specified by name on the cheque. | Payable to whoever holds the cheque. |

| Crossing | Two parallel lines with “A/C Payee” written. | No crossing; cashed by anyone holding it. |

| Security | Highly secure, restricts encashment options. | Less secure, poses a risk of theft or misuse. |

| Endorsement Required | Yes, for transferring funds to someone else. | No, cashable by anyone. |

| Risks | Low risk; theft and misuse are minimised. | High risk; transferable and open to misuse. |

| Transferability | Not transferable; only the payee can deposit it. | Transferable by handing it to another person. |

| Usage | Ensures secure payments, ideal for larger transactions. | Convenient for quick, smaller payments. |

Relatable Example

Imagine you’re sending payment to a vendor for services rendered:

- Crossed Cheque: You want to ensure the payment goes directly into their account. A crossed cheque restricts the transaction to the named payee’s account, making it secure.

- Bearer Cheque: You’re reimbursing a colleague for a small purchase. Handing over a bearer cheque allows them to quickly encash it without further endorsement.

Legal Insights

Recent court rulings and RBI guidelines emphasise the importance of using the right cheque type for transactions.

- In XYZ Bank Ltd vs ABC Corporation, the court ruled in favour of a payee who lost funds due to a stolen bearer cheque, highlighting its inherent risks.

- RBI suggests using crossed cheques for larger transactions to ensure traceability and safety.

Key Takeaways Crossed vs Bearer Cheques

- Use crossed cheques for secure, high-value payments.

- Opt for bearer cheques only for small, immediate transactions.

- Always consider the risks of loss or theft before issuing a cheque.

Understanding the distinctions between crossed cheques and bearer cheques is essential for secure financial transactions. Each type serves specific purposes and carries unique implications.

Crossed Cheques

A crossed cheque features two parallel lines across its face, often accompanied by the words “Account Payee” or “Not Negotiable.” This crossing directs the bank to deposit the cheque amount directly into the payee’s account, preventing over-the-counter cashing. This mechanism enhances security by ensuring that only the intended recipient can access the funds. According to Section 123 of the Negotiable Instruments Act, 1881, general crossing involves two parallel lines, while Section 124 defines special crossing as including the name of a specific banker.

Bearer Cheques

In contrast, a bearer cheque is payable to the person in possession of the cheque. It does not require endorsement, allowing for easy transferability through mere delivery. However, this convenience comes with increased risk; if lost or stolen, anyone holding the cheque can encash it. Banks may request identification for substantial amounts, but generally, bearer cheques are less secure.

Key Differences

- Security: Crossed cheques offer higher security by restricting payment to the payee’s account, reducing the risk of unauthorized access. Bearer cheques are more susceptible to misuse if misplaced.

- Transferability: Bearer cheques can be transferred by simple delivery without endorsement, facilitating quick transactions. Crossed cheques require the payee’s account for deposit, limiting transferability.

- Usage: Crossed cheques are ideal for transactions where security is paramount, such as large payments. Bearer cheques are suitable for smaller, immediate transactions but carry higher risk.

Legal Considerations

The legal framework governing cheques in India is outlined in the Negotiable Instruments Act, 1881. Sections 123 and 124 specifically address the crossing of cheques, detailing the implications of general and special crossings. Understanding these provisions is crucial for both issuers and recipients to ensure compliance and safeguard against potential fraud.

Selecting the appropriate type of cheque—crossed or bearer—depends on the specific requirements of the transaction, balancing convenience and security. For substantial amounts or when security is a concern, crossed cheques are advisable. For smaller, immediate needs, bearer cheques may suffice, provided the associated risks are acknowledged.

Some of them referred from this source

Crossed vs Bearer Cheques