The standard deductions has been a cornerstone of India’s income tax system for salaried individuals and pensioners, simplifying tax calculations while providing relief to taxpayers. But how has this provision evolved over the decades? Let’s take a closer look at the journey of the standard deduction, its key milestones, and its current status in Budget 2025.

What is the Standard Deductions?

The standard deduction allows salaried individuals and pensioners to reduce their taxable income by a fixed amount without needing to provide proof of expenses. It simplifies tax compliance by eliminating the need for documentation, making it a convenient tool for taxpayers.

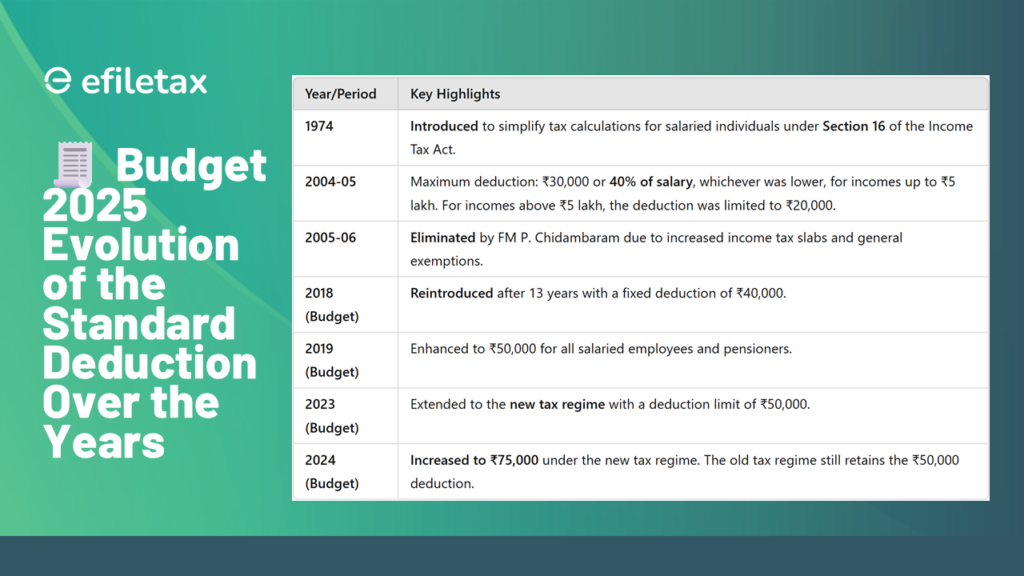

Under Section 16 of the Income Tax Act, 1961, the standard deduction has undergone several changes over the years. Here’s a detailed timeline of its evolution.

The History of Standard Deduction: Key Milestones

1974: Introduction of Standard Deduction

The standard deduction was first introduced in 1974 to provide relief to salaried employees. It was designed to account for work-related expenses without requiring individuals to submit receipts or documentation.

2005: Elimination of the Deduction

In the fiscal year 2005–06, Finance Minister P. Chidambaram abolished the standard deduction. The rationale was that the expansion of income tax slabs and increased general exemption limits rendered the deduction unnecessary.

- Prior to Elimination: Salaried individuals could claim up to ₹30,000 or 40% of their salary, whichever was lower, provided their annual income did not exceed ₹5 lakh. For higher-income individuals (earning above ₹5 lakh), the deduction was capped at ₹20,000.

2018: Reintroduction at ₹40,000

After a 13-year gap, the standard deduction was reintroduced in Budget 2018 at ₹40,000. This move simplified the tax structure for salaried individuals, replacing medical and travel allowances that required documentation.

2019: Increase to ₹50,000

Budget 2019 increased the standard deduction limit to ₹50,000, further enhancing tax savings for salaried employees and pensioners.

2023: Inclusion in the New Tax Regime

Initially unavailable under the new tax regime, Budget 2023 allowed taxpayers opting for the new regime to claim the ₹50,000 standard deduction, providing parity with the old tax regime.

2024: Major Hike to ₹75,000

Budget 2024 introduced a significant change by increasing the standard deduction under the new tax regime to ₹75,000, offering substantial relief to taxpayers. Under the old tax regime, the standard deduction remains at ₹50,000.

Who is Eligible for the Standard Deductions?

The standard deduction is available to:

- Salaried employees: Regardless of their income level, all salaried individuals can claim this deduction.

- Pensioners: Pension income is also eligible for the deduction, offering financial relief to retirees.

Benefits of the Standard Deductions

- No Documentation Required: Taxpayers do not need to maintain records of expenses like medical bills, travel receipts, or investment proofs.

- Direct Reduction in Taxable Income: The deduction reduces gross income, lowering overall tax liability.

- Inclusive Benefit: Available to a wide range of individuals, including salaried employees and pensioners.

Looking Ahead: Will Budget 2025 Bring Further Changes?

As we await the announcement of Budget 2025, many are curious whether the standard deduction will see further revisions. The differences in amounts under the old and new tax regimes may prompt discussions on unifying or further enhancing this benefit.

The standard deduction has played a pivotal role in simplifying tax compliance and providing relief to taxpayers over the years. From its introduction in 1974 to its abolition in 2005 and reintroduction in 2018, it has continually adapted to the needs of salaried individuals and pensioners. The increase to ₹75,000 under the new tax regime in 2024 reflects the government’s efforts to make the tax system more taxpayer-friendly. Will 2025 bring another milestone in this journey? Only time will tell.