Introduction

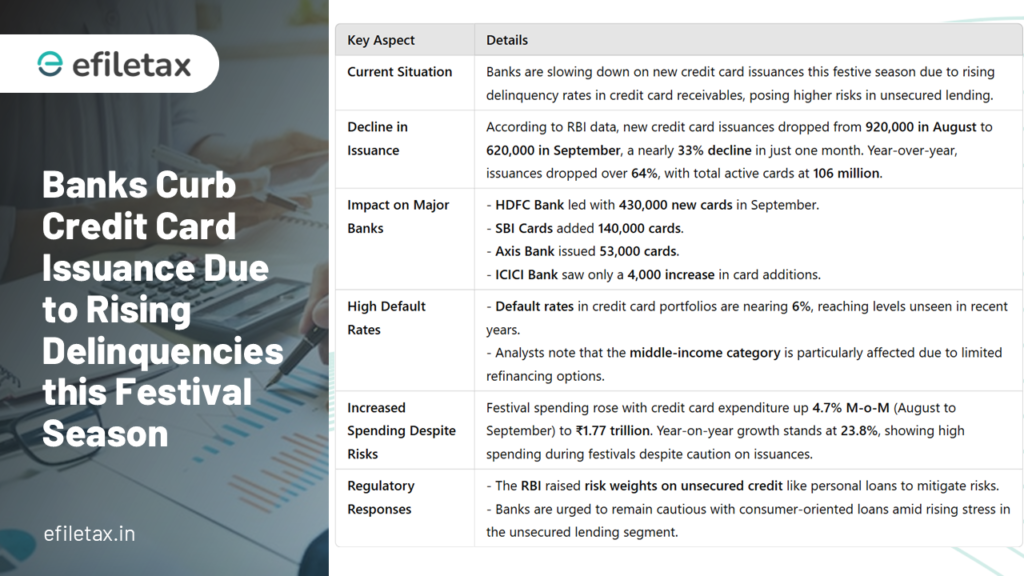

As the festive season unfolds, credit card issuances by banks are taking a significant hit due to rising delinquencies in the unsecured lending segment. Amid the surge in festival spending, banks have adopted a cautious stance, resulting in a sharp decline in new credit card disbursements. This trend reflects growing concerns over increasing default rates, especially among the middle-income group, and points towards a potential slowdown in unsecured consumer lending.

Banks Adopt a Conservative Approach

According to recent data from the Reserve Bank of India (RBI), new credit card issuances witnessed a steep drop from 920,000 in August to just 620,000 in September, marking a decline of almost one-third. Compared to last year, this represents a reduction of over 64%, with the current number of active credit cards standing at around 106 million. These figures highlight a notable shift in banks’ approach to issuing credit cards as they grapple with rising delinquency rates.

The market leaders in this segment, such as HDFC Bank, SBI Cards, and Axis Bank, have all felt the impact. For instance, HDFC Bank issued 430,000 new credit cards in September, followed by SBI Cards with 140,000 and Axis Bank with 53,000. In contrast, ICICI Bank reported an increase of just 4,000 cards. This deceleration reflects banks’ growing concerns over the risk of defaults.

Concerns Over Rising Default Rates

The rise in default rates is a major factor behind this cautious stance. A report by Macquarie Capital points out that default rates in banks’ credit card portfolios have reached nearly 6%, levels not observed in recent years. This situation is especially severe in the middle-income category, where borrowers are struggling to refinance debt, largely due to tighter regulations on personal loans.

Suresh Ganapathy, head of financial services research at Macquarie Capital, noted that the financial strain on the middle class has been exacerbated by a slowdown in urban economic activity. With fewer avenues for refinancing and increasing financial obligations, more cardholders are falling behind on their payments.

Festival Spending Still on the Rise

Interestingly, despite the decline in new credit card issuances, total credit card spending has seen an uptick during the festive season. In September, total card expenditure reached Rs 1.77 trillion, up from Rs 1.69 trillion in August, indicating a 4.7% month-on-month increase and a 23.8% year-on-year rise. However, the growth rate of transaction volume dipped from 1.6% in August to just 0.5% in September, suggesting that while overall spending is up, the pace of individual transactions has slowed.

The RBI’s Response to Rising Delinquencies

In response to the rising delinquencies in the unsecured lending segment, the RBI has raised the risk weights on unsecured credit, including personal loans and credit extended to non-banking financial companies (NBFCs). These measures, implemented in November 2023, are aimed at ensuring that banks remain cautious in their lending practices, particularly in areas prone to higher default risks.

Conclusion

The festive season is typically a time of increased consumer spending, but this year it has also brought to light the growing financial pressures faced by many households. With rising delinquency rates and tighter regulatory measures, banks are increasingly hesitant to issue new credit cards, particularly to those in the middle-income segment. As the economy continues to navigate these challenges, a cautious approach from lenders might become the norm, emphasizing stability over rapid growth in the unsecured lending market.