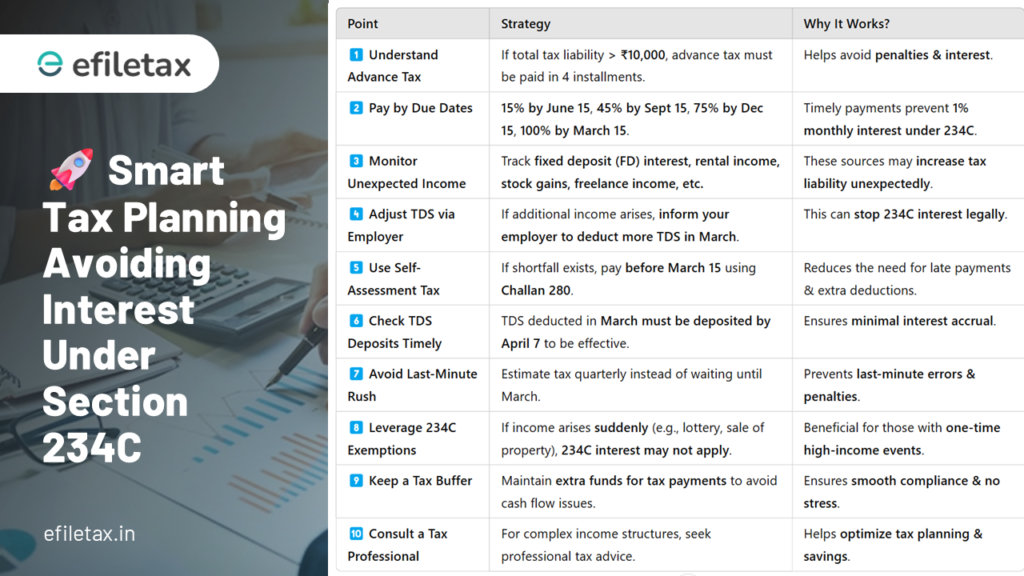

Avoid Section 234C Interest: A Clever Tax Hack for Salaried Individuals in 2025

Missed paying advance tax on extra income like bank FD interest? Don’t worry! You can still avoid Section 234C interest (a 1% monthly penalty) by using a simple strategy: report your additional income to your employer and have them deduct more TDS from your March salary. This little-known hack can save you thousands in penalties, and it’s perfectly legal under India’s tax laws as of March 2025.

In this article, we’ll break down how this trick works, back it up with legal insights, and show you how to implement it seamlessly. Whether you’re a salaried professional, freelancer, or business owner, this guide will help you navigate advance tax rules with confidence.

What Is Section 234C, and Why Should You Care?

Section 234C of the Income Tax Act, 1961, penalizes taxpayers who fail to pay advance tax on time. If your tax liability exceeds Rs 10,000 in a financial year, you’re required to pay advance tax in installments:

- 15% by June 15

- 45% by September 15

- 75% by December 15

- 100% by March 15

Failure to meet these deadlines triggers a 1% per month interest on the shortfall, starting from April 1 of the next financial year until the tax is fully paid. For example, if you owe Rs 1,20,000 in taxes but miss the March 15 deadline, you could face an interest of Rs 1,200 per month until you settle the dues.

This penalty can add up quickly, especially for salaried individuals with additional income sources like fixed deposits, rental income, or capital gains, where advance tax often gets overlooked.

The Smart Tax Hack: Use TDS to Avoid Section 234C Interest

Here’s the game-changer: instead of scrambling to pay advance tax directly, you can report your additional income to your employer and ask them to deduct more Tax Deducted at Source (TDS) from your March salary. This ensures the tax on your extra income is paid before the financial year ends, minimizing or even eliminating the interest under Section 234C.

How It Works: A Step-by-Step Guide

- Calculate Your Additional Income: Identify income not already taxed, such as interest from bank fixed deposits (FDs). For instance, if you earned Rs 4 lakh in FD interest, your tax liability at a 30% slab rate would be Rs 1,20,000.

- Inform Your Employer: Under Section 192 of the Income Tax Act, employers are obligated to deduct TDS based on your total estimated income. Share your additional income details with your HR or payroll team.

- Adjust TDS in March: Request your employer to deduct the tax on this additional income from your March salary. In the example above, they’d deduct Rs 1,20,000 as TDS.

- Minimize Interest: According to a 2004 CBDT Circular (No. 7/2004), TDS deposited by April 7 (the deadline for March deductions) stops the interest clock under Section 234C from that date. This means you’d only face a few days of interest (April 1 to April 7), which is negligible—often less than Rs 500!

Real-World Example

Let’s say you earned Rs 4 lakh in FD interest in FY 2024-25 but forgot to pay advance tax. Your tax liability on this is Rs 1,20,000 (30% slab). If you miss the March 15 deadline, you’d owe Rs 1,200 per month in interest under Section 234C starting April 1, 2025. That’s Rs 4,800 if you pay by July 31, 2025 (return filing deadline).

Instead, you report the Rs 4 lakh to your employer in February 2025. They deduct Rs 1,20,000 as TDS from your March salary, depositing it by April 7. Now, the interest applies only from April 1 to April 7—a mere 7 days. At 1% per month, this is roughly Rs 280 (Rs 1,20,000 * 1% * 7/30), saving you Rs 4,520 in penalties!

Legal Backing: Why This Works

This strategy isn’t a loophole—it’s grounded in India’s tax laws. The Central Board of Direct Taxes (CBDT) clarified in Circular No. 7/2004 that interest under Section 234C stops once tax is paid through TDS or self-assessment, even if paid after March 15 but before filing your return. This means TDS deducted in March and deposited by April 7 effectively halts the interest penalty.

Additionally, a 2019 Supreme Court case, CIT vs. Eli Lilly & Co. (India) Pvt. Ltd., reinforced that TDS deductions are treated as tax payments on behalf of the employee. The court ruled that such payments should be considered when calculating interest under sections like 234C, giving salaried individuals a legal basis to use this method.

The Reserve Bank of India (RBI) also reported in its 2024 Annual Report that interest income from fixed deposits rose by 12% in FY 2023-24, highlighting the growing need for taxpayers to manage such income effectively to avoid penalties.

Who Can Benefit from This Strategy?

This hack is a lifesaver for:

- Salaried Professionals: If you have side income like FD interest or rental income, this method ensures you don’t get slapped with penalties.

- Freelancers with Salary Income: If you’re a freelancer who also earns a salary (e.g., part-time employment), you can use your employer’s TDS mechanism to cover taxes on freelance income.

- Business Owners with Employees: If you’re a business owner paying yourself a salary, you can instruct your payroll team to adjust TDS for your personal additional income.

Expert Insights: What Tax Professionals Say

According to tax expert CA Rohit Sharma, “Many salaried individuals overlook advance tax on non-salary income, leading to Section 234C interest. Reporting to your employer is a practical workaround, especially since TDS adjustments are now easier with digital payroll systems in 2025.”

The Securities and Exchange Board of India (SEBI) also noted in a 2024 report that retail investors are increasingly earning capital gains, another area where advance tax often gets missed. Adjusting TDS through salary can help here too.

FAQ Section: Common Questions About Section 234C

Q: Can I avoid Section 234C interest if I pay advance tax after March 15?

A: Partially. Interest applies from April 1 until the date you pay. However, using TDS in March, as explained, minimizes this period to a few days.

Q: What if my employer refuses to adjust TDS?

A: You’ll need to pay advance tax directly or settle the tax with interest during return filing. Communicate early with your HR to avoid this issue.

Q: Does this strategy work for non-salaried individuals?

A: No, this is specific to those with salary income, as it relies on employer TDS deductions.

Q: Are there other ways to avoid Section 234C interest?

A: Yes, paying advance tax on time or opting for tax-saving investments under Section 80C can reduce your liability.