India’s tax enforcement has entered a new era.

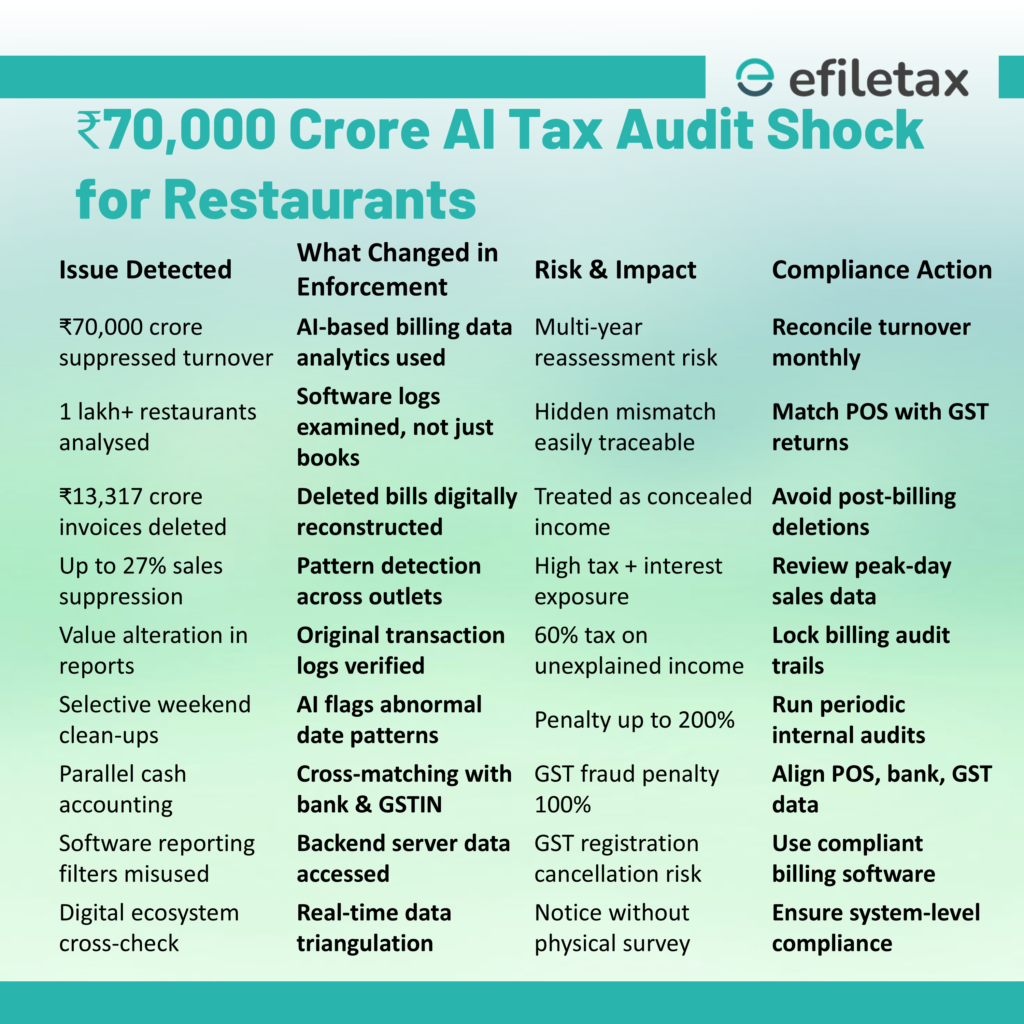

In a large-scale data investigation, the Income Tax Department analysed billing software records of more than one lakh restaurants across the country. The results revealed widespread manipulation of digital billing — including deleted invoices, altered values and selective reporting — leading to an estimated ₹70,000 crore of suppressed turnover.

This is not just a case about restaurants.

It marks a structural shift in how tax authorities detect evasion: from physical inspection to digital reconstruction of income.

What Exactly Was Discovered

Authorities examined transaction-level data from a widely used billing platform. Using analytics tools and AI-based pattern detection, they identified several manipulation techniques.

Key Findings

- ₹13,317 crore worth invoices deleted after billing

- Up to 27% sales likely hidden in many outlets

- More than 1 lakh restaurant records analysed

- Hundreds of high-value suppression cases above ₹1 crore

- Major detections in Karnataka, Telangana and Tamil Nadu

- Sales reconstructed by mapping GSTIN and transaction logs

The department did not rely on cash seizure or surveys.

Instead, they rebuilt the actual turnover from software trails.

How Restaurants Manipulated Turnover

The investigation highlighted a common myth among businesses — that deleting a bill removes tax liability.

In reality, digital footprints remain permanently stored in multiple layers of systems.

Common Techniques Identified

1) Post-Billing Deletion

Bills generated and shown to customers were removed later from final reports.

2) Value Suppression

Final accounts reflected lower amounts than original billing entries.

3) Selective Date Clean-ups

Data wiped only for peak days like weekends and holidays.

4) Parallel Cash Accounting

POS showed one figure while books recorded another.

5) Software-Based Reporting Filters

Reports exported after applying hidden filters inside billing software.

Why This Case Is Different From Past Tax Raids

Earlier tax detection relied on:

- Physical inspection

- Stock verification

- Cash difference

- Statements

Now detection relies on:

- Transaction logs

- Server backups

- API data sharing

- GST analytics

- AI pattern comparison

Authorities can reconstruct income even if:

- Bills are deleted

- Software is replaced

- Data is partially removed

Because digital ecosystems retain indirect evidence.

The New Compliance Risk: Your Software Is Now Your Audit Trail

Every modern business uses connected systems:

- POS software

- GST portal

- Payment gateways

- Online aggregators

- Bank settlement reports

- Inventory software

These systems cross-verify each other automatically.

If turnover mismatches across platforms, it creates a risk profile.

Possible Legal Consequences

Where suppression is established, businesses may face multiple actions simultaneously.

Income Tax Exposure

- Reassessment of past years

- 60% tax on unexplained income

- Penalty up to 200%

- Prosecution in serious cases

GST Exposure

- Tax + interest recovery

- 100% penalty for fraud cases

- Blocking of e-way bill facility

- Cancellation of GST registration

Additional Impact

- Bank scrutiny

- Loan rejection

- Vendor compliance mismatch notices

What Businesses Should Learn From This

This investigation proves one important principle:

Compliance today is system-driven, not document-driven.

Even if records appear clean, backend data trails can reveal reality.

Practical Compliance Steps for Businesses

1) Reconcile All Systems Monthly

Match:

- POS reports

- GST returns

- Bank credits

- Payment aggregator reports

2) Avoid Manual Editing of Sales Data

Any post-billing changes create audit flags.

3) Maintain Immutable Billing Records

Use software with locked audit logs.

4) File Correct GST Returns

Short reporting creates future reassessment risk.

5) Conduct Periodic Internal Reviews

Annual correction is late. Continuous review is essential.

What This Means for the Future

The government is moving toward predictive tax enforcement.

Instead of catching evasion after years, authorities can now detect anomalies within months using:

- AI analytics

- Networked compliance systems

- Real-time data matching

Industries expected to see similar scrutiny:

- Retail

- Clinics & hospitals

- Jewellery

- Construction services

- E-commerce sellers

Conclusion

The ₹70,000 crore restaurant suppression detection is not just a tax case — it is a technological turning point in Indian compliance.

Businesses are no longer audited only by officers.

They are audited by algorithms.

If reported turnover does not match digital behaviour, authorities can reconstruct income independently.

The safest strategy today is simple:

Ensure your systems, returns and books all tell the same story.